-

Zero-Down USDA Mortgage brokers compared to FHA against Old-fashioned 97

Zero-Down USDA Mortgage brokers compared to FHA against Old-fashioned 97 Exactly how Affordable Is USDA Home loans?

The us Institution from Farming (USDA) financing, called the (RD) mortgage, demands zero down payment that is offered to down-borrowing people.

Interest in these funds keeps growing just like the customers learn the gurus. More 166,000 household put a good USDA mortgage inside fiscal year 2015 alone, with respect to the company.

Customer desire is not stunning. New USDA loan is the only on the market for home buyers instead of army services record.

Rural Invention money are available centered on location of the assets, perhaps not life sense. Especially, USDA people you want only to look for a home inside good rural city due to the fact discussed because of the USDA. Nevertheless concept of outlying is quite liberal: on 97 percent of all You.S. property mass is eligible.

USDA Pricing And you can Mortgage Insurance coverage

USDA financing succeed 100% funding, definition zero down-payment is needed. Simply because USDA financing are insured, or supported, of the You.S. bodies.

Zero down-payment does not always mean customers shell out high pricing. USDA financing provide equivalent otherwise all the way down pricing than can be found with FHA otherwise traditional loans.

USDA loans, not, keeps a slight drawback versus Conventional 97 because it have an upfront fee of just one.00% of the loan amount. The cost isn’t needed within the dollars at closure. As an alternative, extent is covered into the dominant balance and you will paid back throughout the years.

USDA Will set you back Compared to the FHA and Traditional 97

The reality that USDA loans don’t need an advance payment conserves brand new home visitors a substantial number upfront. Which reduces the timeframe it entails a purchaser to help you be willing to purchase a home.

Most other reduced-deposit options, like FHA loans otherwise a conventional 97, nonetheless want a down-payment regarding step 3.5% and you will step 3% respectively.

With the average house price of about $250,000, an effective USDA debtor would need $8,750 quicker initial than just an enthusiastic FHA borrower.

USDA fund incorporate a higher equilibrium, due to lowest deposit, but that is slightly offset of the straight down costs and much more reasonable home loan insurance.

Deposit

- USDA: $0

- FHA: $8,750

- Antique 97: $eight,five hundred

Amount borrowed

- USDA: $252,five hundred

- FHA: $245,471

- Antique 97: $242,500

Monthly Dominating, Notice, And Home loan Insurance coverage

- USDA: $1,280

- FHA: $step 1,310

- Traditional 97: $step 1,385

Keep in mind that these types of payments do not become almost every other costs such property taxation and you can homeowner’s insurance policies, and are generally considering try, and never real time, pricing and ple signifies that USDA demands a comparable monthly payment than the FHA, with no step 3.5% deposit.

Whilst the USDA loan amount was higher due to zero down payment, monthly premiums are exactly the same otherwise below one other choice.

Payment per month is far more important than dominating equilibrium for the majority customers. All the way down month-to-month costs make USDA loan less costly having group with strict finances.

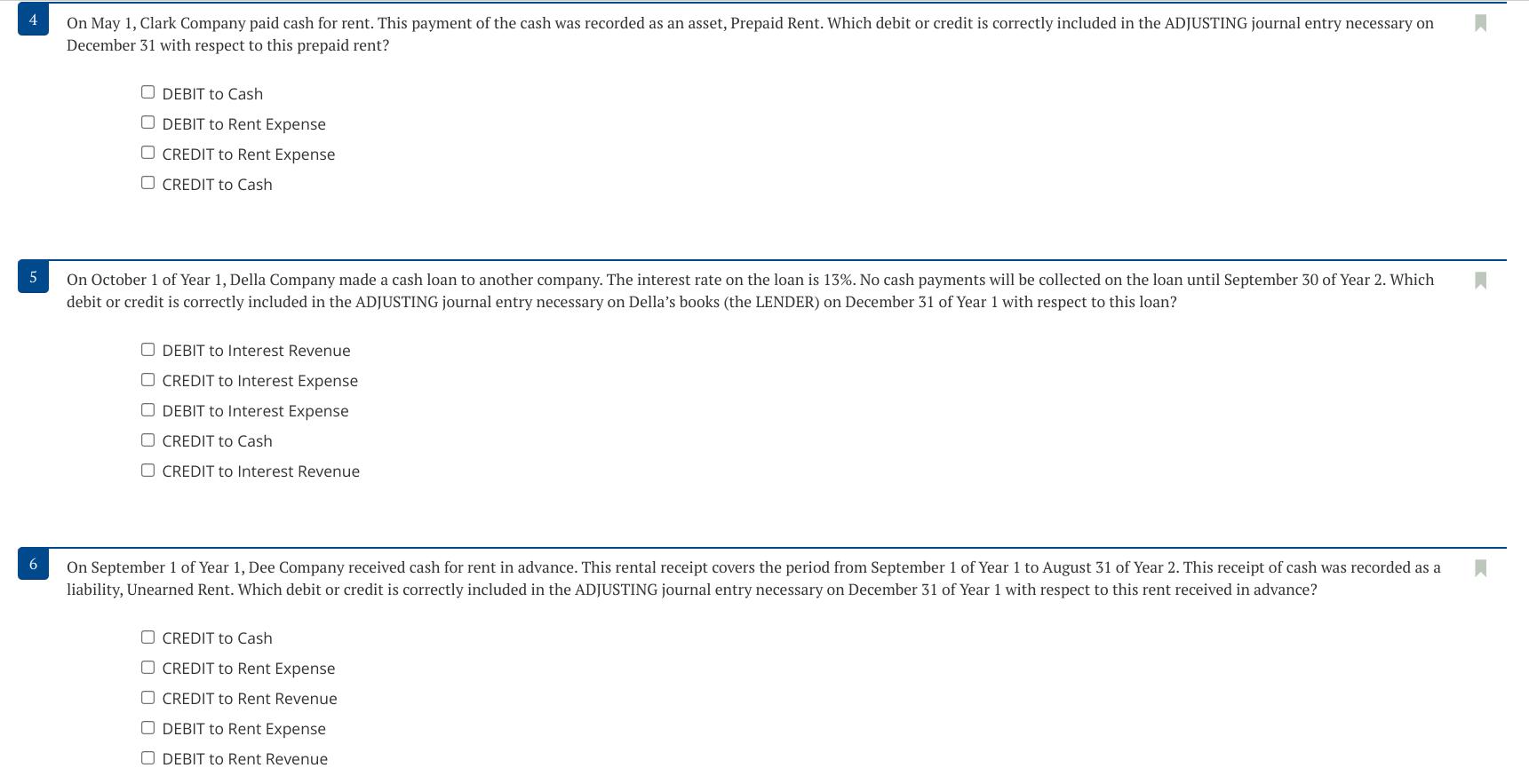

Minimal Credit rating Getting A good USDA Home loan

USDA lenders keeps most other advantages as well as lower very first and you can monthly will cost you. There is also versatile borrowing from the bank requirements versus almost every other loan items.

To own a great USDA loan, homebuyers will only need a credit score out-of 640. Fannie mae recommendations put minimal credit history on 620 to own a traditional 97, whether or not lenders usually typically place a top minimum of 640 in order to 680.

The sole popular financing system having less needed credit rating try FHA, and therefore merely need a credit score regarding 580.

USDA Money Restrictions Ensure Availableness To have Modest Earners

USDA home Nunn cash advance loans are available to buyers at the or below specific income limitations. Which guidance is set in place to be sure the application is employed by the people who want it very.

Nevertheless the money limitations to own good USDA was reasonable. Become USDA qualified, the home client helps make to 115% of one’s area’s median money. And when children out-of five, below are the new annual money constraints for many significant elements:

Huge parents are allowed and make a whole lot more. Such as, a household of 5 or higher from the La town make $129,600 whilst still being qualify.

What are The current Prices?

Since the USDA funds try backed by the usa Agency from Farming, they give you advantages one other programs do not, for example short upfront will set you back and super-lower costs.

This new sagging criteria, effortless value and you will 100% capital available with good USDA mortgage create an emotional alternative to beat.

Get a great USDA rate quote, which comes having an enthusiastic assets and income eligibility view. All of the quotes is entry to their real time credit scores and good custom monthly payment estimate.

*The new repayments revealed above suppose a great 720 credit score, single house, and you can assets when you look at the Arizona County. Old-fashioned 97 PMI cost are given from the MGIC Ratefinder. Payments dont is property taxes, homeowner’s insurance coverage, HOA expenses or other can cost you, and therefore are according to analogy APRs that are meant to demonstrated an assessment, maybe not already-available pricing. Try APRs put are as follows: USDA cuatro% APR; FHA step three.75% APR; Conv. 97 cuatro.25% Apr. Seek the advice of a loan provider here having a customized rate and you can Apr quote.