-

You would like a loan? You can faucet their Teaspoon

You would like a loan? You can faucet their Teaspoon So long as we’re nonetheless operating, we can borrow money from your Thrift Deals Plan membership of the technique of a teaspoon loan. Extremely workplace paid defined sum agreements support finance. We do have the capability to capture either (otherwise both) a standard objective financing and an initial quarters mortgage.

Finance from discussed contribution preparations try restricted in this they can not be for over $50,000, it doesn’t matter what far currency you’ve got on your account. Individuals with brief stability (less than $100,000) is actually limited on the amount they’re able to use to 1-half its balance.

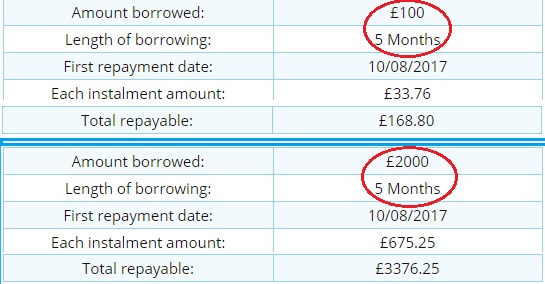

A broad goal mortgage is actually for any excuse you would like they getting to possess. It will take no paperwork at all and can feel amortized more an excellent age of to 5 years.

You can avoid make payment on taxation if, within two months about big date of your 1099, you import a cost equal to the a great mortgage balance for the an IRA (or other income tax-deferred account)

A primary residence loan should be backed by documentation and certainly will be amortized over a period of to 15 years. Paperwork criteria are listed in the TSP’s publication for the finance, that’s available from the And keep planned that you online personal loans in Arkansas bad credit get a primary household mortgage to possess an Rv otherwise an effective houseboat so long as you use them as your prominent residence!

Zero disbursements can be made from your membership up to people an excellent money was closed

Discover a couple of conditions you to apply to one another items off Tsp fund. When you find yourself secure underneath the FERS retirement system, their spouse’s consent becomes necessary for a financial loan, and other withdrawal option for one count. An excellent $fifty app commission is necessary also. The application costs are used to assist defray Teaspoon costs. And additionally, you aren’t allowed to apply for a different sort of mortgage of your exact same sorts of contained in this 60 days regarding repaying a past financing.

When taking a tsp mortgage, the Teaspoon membership would-be less proportionately by the number of the borrowed funds. Instance, if perhaps you were equally purchased the five basic funds and borrowed $50,000, the amount of $10,000 is subtracted out-of for every single financing. The speed you only pay is dependant on the latest come back off the new Grams funds about week in which the loan are accepted, and is published about loan and you will annuity pricing section of the Teaspoon site (with it is 2.875%). The interest you pay extends back into your Teaspoon membership according towards latest Teaspoon share allowance. Both the mortgage and the money need to be proportional amongst the Old-fashioned and you may Roth Teaspoon balance.

The new Thrift Board discourages money due to the fact, in most cases, credit out of your later years will result in less of your budget getting readily available for your advancing years. This will be according to research by the presumption one to many Teaspoon players has its financial investments in the inventory loans (i.elizabeth., C, S or We), in which, in the most common decades, brand new come back try higher than regarding the new Grams funds. Naturally there are conditions to that particular code 2015 and you will 2008 started readily to mind.

For many who exit federal service rather than paying off a fantastic mortgage, you might be offered the option of spending they straight back otherwise delivering a nonexempt shipments. While the Teaspoon get observe of one’s breakup from the institution (it often takes to thirty day period), you happen to be delivered guidelines on the re also-paying your loan. The fresh find will provide you with a romantic date by which the borrowed funds must be paid back. If you do not re-spend the money for mortgage contained in this that time several months your loan is certainly going to your standard in addition to outstanding balance of one’s financing is managed as a taxable shipment. Brand new Tsp will send both you and the newest Internal revenue service a type 1099 to this impact. If you do not plan on re also-purchasing the loan, you can contact the new Tsp and ask for a direct commitment from shipments.