-

Which twice tax ‘s the double-edged blade off fund

Which twice tax ‘s the double-edged blade off fund The new analogy in the Contour step one depicts this time. Triplets James, John, and you can Jack scholar university and you can see manage an identical organization, although around three implement other advancing years coupons tips. James throws $dos,100 annually out of decades 25-65 into the their domestic safe. John spends $dos,one hundred thousand a year regarding ages twenty-five-forty five following concludes. Jack uses $dos,one hundred thousand per year to your holidays to have twenty years and then spends $2,100 annually from ages forty-five-65. Each other Jack and John found six.5% focus compounded annually. What will its old age financing look like when they all the retire in the ages 65?

Shape 2 reveals how the same capital regarding $2,100 grows more than a good ten to thirty-year period which have efficiency between five so you’re able to 9 %.

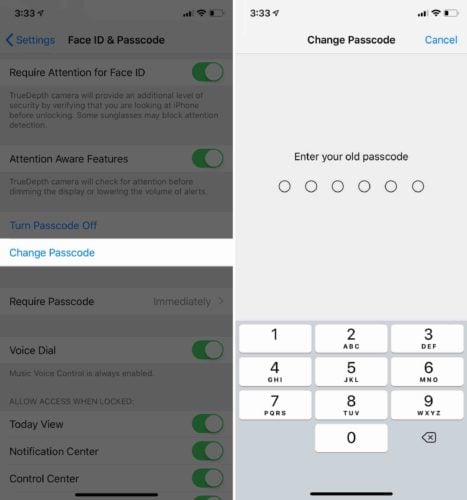

For people who subscribe to their 401(k) intend on a great pre-tax basis or take a loan out of your membership, you’re using your self right back for the a later on-tax foundation

6. Financing in a great 401(k) plan tends to be a dual-edged blade. After you retire and you may spreading your account, you’re going to have to pay taxation again.

For folks who cancel employment which have an outstanding financing, when you find yourself your account equilibrium can be eligible to stay in this new plan, your loan tend to standard if you’re unable to spend the money for matter in the complete before the avoid of elegance months.

It is additionally vital to understand that deleting your own hard-won funds from the 401(k) plan reduces the timeframe that money is accruing money and you can compounding attract. Excite take the time to think about the outcomes before requesting financing from the 401(k) account.

seven. You might not be entitled to all your account balance if your cancel and take a shipment. Whenever you are any money deferred out of your compensation is definitely a hundred% your if you leave the company, company contributions are at the mercy of a great vesting schedule. What is actually an effective vesting plan? An effective vesting schedule lies out the number of years in which you really must be employed in buy to make complete ownership out of men and women employer efforts. Different types of employer benefits are subject to additional vesting dates. A very common illustration of an excellent vesting agenda ‘s the half a dozen-seasons rated vesting plan, found during the Contour step 3 less than. What that it agenda means is you must functions half a dozen age to help you in order to get complete possession of the boss contributions on the account. For many who cancel a career with 3 to 5 several years of service you might be permitted brand new relevant vested percent nevertheless rest of the membership could well be forfeited back again to the latest manager.

Simultaneously, by using financing and are also not able to shell out https://paydayloanalabama.com/uriah/ they back into the in depth time, the loan might be an early delivery, nonexempt in your loan goes into default, and may even become at the mercy of a supplementary ten% for the punishment fees

While unsure whether your boss efforts was susceptible to a beneficial vesting plan or should your bundle offers one hundred% immediate vesting, you will want to speak to your conclusion bundle description.

8. 401(k) levels is actually cellular phone. If you have more than one 401(k) membership, you can combine your levels of the moving (otherwise rolling over) the new membership with your earlier manager into your the newest manager plan. Running more than their profile is very effective because it makes you move your bank account about prior employer’s package in the place of running into one shipping punishment.

nine. 401(k) agreements would be influenced by taxation reform. On the wake of your own recent election, the news has been full of statements centered around tax reform. Circulating hearsay imagine your aim of the latest You.S. Congress into the 2013 would be to dump or get rid of taxation write-offs and cut the deficit. I understand you will be thought these deduction cutbacks tend to generally affect employer-sponsored health care and won’t suggest something to suit your 401(k), you that 401(k)s was basically adversely affected by income tax reform in the past.