-

The essential difference between A predetermined-Price and you can Arm Home loan for Mortgage refinancing

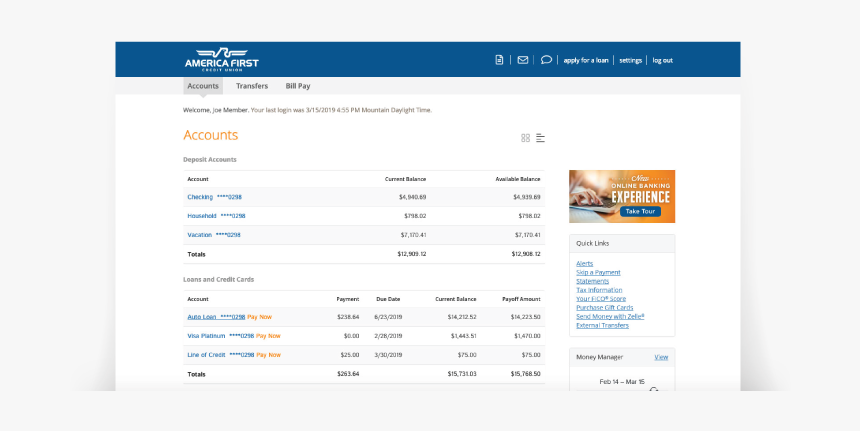

The essential difference between A predetermined-Price and you can Arm Home loan for Mortgage refinancing With respect to eligibility to own refinancing a keen financial, credit scores and you may credit score play a crucial role. Loan providers typically have specific minimum credit score conditions having refinancing. If you find yourself these types of standards can vary, a higher credit score gives you a greater danger of conference this type of criteria. Loan providers contemplate factors eg financing-to-well worth ratio, debt-to-earnings proportion, and you will a career records when determining eligibility.

cuatro. Influence on Interest rates

Fico scores and you may credit score enjoys an impression to the interest levels given whenever refinancing a keen financial. Lenders have a tendency to promote straight down rates to consumers with high credit scores and you will an optimistic credit history. Simply because an excellent borrowing from the bank profile signifies a reduced chance off default and offers lenders confidently on your capability to pay-off the loan. Concurrently, a lower life expectancy credit history otherwise an awful credit rating may result inside higher interest levels, given that loan providers understand increased chance with the financing to you personally.

Credit ratings and you can credit score are vital you should make sure whenever refinancing a keen financial. It effect eligibility having refinancing and gamble a serious part inside the deciding the interest cost provided. From the keeping good credit and you may a confident credit score, you might increase probability of securing advantageous conditions and achieving your own refinancing requirements. Therefore, definitely keep a close vision on your own credit character because you carry on the refinancing journey.

With regards to refinancing mortgage, it is necessary to understand the difference in a predetermined-rate financial and you may a varying-rate financial (ARM). Both of these brand of mortgages effect just how your monthly installments is calculated and can have a serious effect on your current monetary disease. Why don’t we dive toward all these home loan brands to see just how they interact with the field of refinancing a mortgage.

Fixed-Rate Mortgages: Balances inside Not sure Times

A predetermined-price mortgage is like a professional dated pal who sticks from the your front by way of thicker and you will narrow. With this particular kind of home loan, the pace remains lingering on the financing identity, taking balance and predictability. As a result their month-to-month home loan repayments are still the newest exact same, no matter one fluctuations about broader business.

To own people seeking security and you will assurance, a predetermined-rate home loan is usually the wade-to help you solutions. It allows one to bundle your finances effectively, as you know simply how much you will end up using per month. This type of home loan is particularly appealing throughout the times of financial suspicion or whenever rates of interest are on an upswing.

Adjustable-Rates Mortgage loans (ARMs): Drive new Trend out-of Market Changes

When you find yourself feeling some time daring and you will available to turning to the newest unforeseen, an adjustable-speed financial (ARM) might possibly be your chosen solution. Rather than its repaired-rate equal, a supply is sold with mortgage loan that may change-over time. Generally speaking, the speed is restricted to own a primary period, tend to as much as five or eight ages, right after which changes sporadically based on field criteria.

This new attract of an arm is dependent on the potential when planning on taking benefit of straight down rates subsequently. If rates drop off, your month-to-month mortgage payments might drop-off. There is always the chance you to rates tend loan places Reform to increase, resulting in higher money. It suspicion renders a supply a bit more will-wracking for the majority of property owners, but for people who find themselves happy to bring a calculated chance, it can be a vibrant possible opportunity to save money from the long term.

Refinancing a mortgage: Merging the very best of Each other Worlds

Since i have good knowledge of fixed-price and adjustable-rate mortgages, let’s talk about the way they fit into the concept of refinancing mortgage. Inside an enthusiastic home loan, the new debtor takes out a couple of loans to cover total number of one’s house’s cost: a first home loan to own 80% of the pricing and you will a vacation mortgage (labeled as a beneficial piggyback financing ) into the kept 20%.