-

Strengthening Very first-Big date Homeowners: Your Area Bank’s Character

Strengthening Very first-Big date Homeowners: Your Area Bank’s Character Buying your first home is a vibrant and extreme milestone. It’s also probably one of the most very important purchases your will ever generate. Navigating the reasons and you will financial possibilities overpower possibly the really informed borrowers. This is when a reliable reference to your neighborhood financial is available in! People finance companies bring individualized functions and you can qualified advice designed to see the initial requires out of basic-time homebuyers.

Let us talk about the many money possibilities and you will speak about how the right banking mate also provide assistance at each and every stage of the property-to buy excursion.

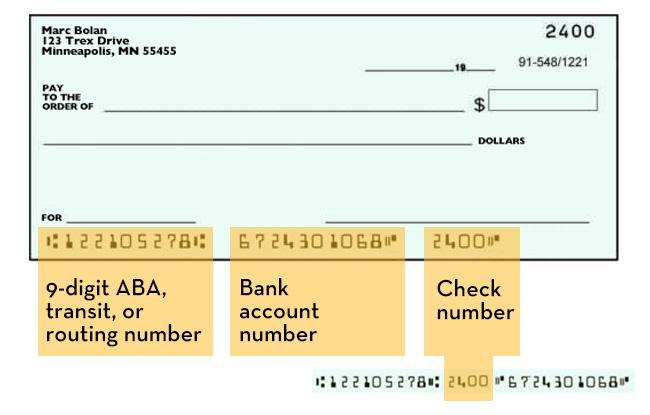

Banking and you may Money Options

Once you have an excellent knowledge of different resource solutions, the next thing is to a target qualifying to own a house loan.

Qualifying for a mortgage

Protecting a home loan pertains to numerous strategies, plus borrowing inspections and you can income confirmation. A good starting point is to try to chat to neighborhood Mortgage Mortgage Manager (MLO). They will direct you from the conditions off a loan application and help you with their pre-acceptance consult. A home loan pre-acceptance try an option step-in the house-to buy techniques because can help you describe your finances. Its especially important whilst enables you to shop having trust and get recognized as a critical buyer. After pre-approved, you realize their business to shop for fuel and will start looking for your dream house in your sensible range.

Brand new Role regarding a Bank’s Home mortgage Officer and you can Party in Your house To order Process

Their MLO usually take you step-by-step through the latest pre-approval techniques, making certain you may have everything required to own a profitable application for the loan. When you identify a home, and also a successful promote to order, they are going to show you from the application for the loan process and review the job each step of your means.

On the other hand, your loan Control group would-be emailing you with the good regular basis, bringing updates into condition of your own financing request as well given that second strategies to cease people shocks.

Brand new Closing/Label Broker is in charge of contrasting the title to spot liens, control and you can making certain that you are ready to possess closing ahead.

Describing Closing costs

MLOs will explain costs and you will fees associated with to order a house, also escrow membership and exactly how they are managed in domestic-to order process. They will render an in depth report on prominent settlement costs and you can help estimate this type of expenditures, which may is:

- Origination Charges: Fees recharged from the lender to possess processing the loan software.

- Appraisal Charge: Charges having employing a specialist appraiser to select the market price of the home.

- Term Insurance coverage: Insurance you to definitely handles both you and the lending company up against any issues with the brand new property’s identity.

- Lawyer Costs: Costs for property search and legal counsel inside the closure procedure.

- Recording Fees: Costs to have recording new mortgage and you will deed to your local bodies.

- Prepaid Can cost you: Initial money to possess property taxes, home insurance, and financial notice.

MLOs and their mortgage control teams is actually your ex lover when you look at the completing your house financing get and certainly will address questions web you may have in the process.

What things to Look out for in an ideal Community Financial Mate

Selecting the most appropriate bank try an important help making certain a good easy domestic-to invest in processes. An ideal people lender will bring more than just monetary features – it’s got personalized appeal, qualified advice, reputable assistance, and you may an intense comprehension of the local housing industry and you can financing alternatives. Such services help you create told line purchases, reducing fret. Here are key features to adopt:

- Custom Provider: Choose a financial spouse that gives personal attention and customized options. Educated and experienced mortgage loan officers will be assist you through the techniques, tailoring ways to your unique need.