-

Navy Government user claims getting rejected left him perception shocked and you can hurt

Navy Government user claims getting rejected left him perception shocked and you can hurt Which is a rather stark disparity, Rice said. It’s unusual for people to see era the spot where the financial rejects more fund than it approves.

Gurus said that Navy Federal’s racial disparities looked like an specifically high example of a bigger national condition. The financing union’s gap anywhere between White and Black colored recognition costs features popped somewhat nowadays and one of all the loan providers, the racial recognition speed gap has also grown.

Far more broadly, the brand new gap when you look at the homeownership pricing between White and you will Black colored Us americans are huge today than it was till the Civil rights day and age and it’s really a key driver out of wide range disparities anywhere between Light and Black household.

When Bob Otondi ran house query in the summer out-of 2021, the guy immediately realized as he found their fantasy house. The three-rooms household in a good lakeside neighborhood off a good Dallas area got an unbarred kitchen area, an inflatable yard that have a pool, and first off it was when you look at the a great school district where Otondi’s young buck had much time aspired to visit senior high school.

Otondi is actually thrilled when their bid toward household is actually recognized, and requested one to his financial software having Navy Government is hanging around. The new cousin out-of Navy servicemembers, Otondi was good Navy Federal customer for decades.

But, only weeks prior to he had been arranged to close off on the get, Otondi had not so great news: Navy Federal try denying his application. The credit connection informed him in a form letter so it got concluded their income wasn’t satisfactory to help you make up their bills.

The credit partnership had pre-approved him, the guy told you he’d successfully paid multiple previous Navy Federal car finance, and he got budgeted a downpayment of more than 20% of your house’s well worth

Otondi said the final-time assertion failed to sound right. Centered on https://paydayloansconnecticut.com/jewett-city/ data files the guy provided to CNN, he was generating than simply $100,000 per year of his strategies providers and had a credit rating over 700. He said the guy did not have high bills.

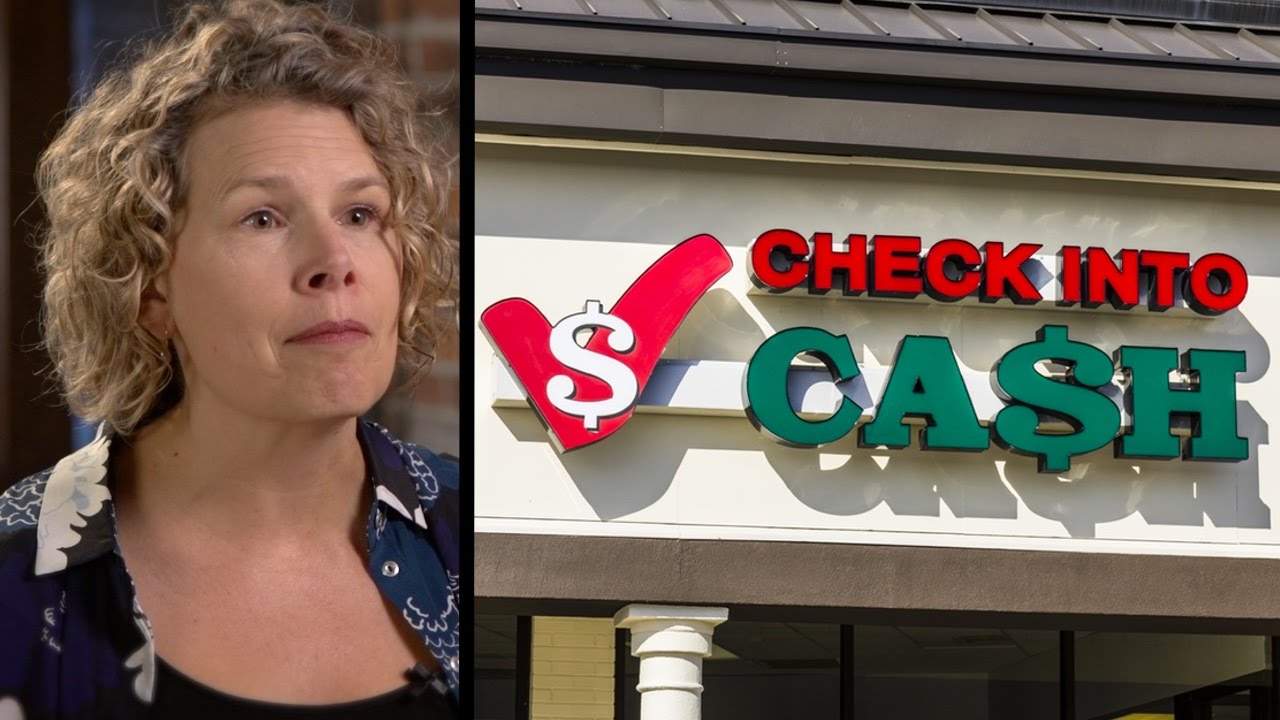

On the temperature of the pandemic-day and age housing market, Otondi feared he’d eliminate the house. I happened to be surprised, I found myself shocked, I happened to be damage, the guy said. He was driving by house with his young man and you will child every week, and also the students had already organized out decorations for their bed room. To return household and you will let them know, dudes, i forgotten the house?’ After all, disastrous, Otondi told you.

However, Otondi’s agent, Angela Crescini, connected him having a different sort of home loan company just who acknowledged your getting a great loan within 14 days and the pick had.

There clearly was no genuine reason he cannot keeps gotten the mortgage off Navy Federal, Crescini told you. How can i lender score financing done within 15 days and this other that couldn’t anyway? They don’t band right to me.

Pearson, the newest Navy Federal spokesperson, denied in order to touch upon Otondi’s denial, saying that the members’ personal and you may username and passwords are private and you can private.

When he sat on the airy living room area of one’s about three-bed room domestic past few days, Otondi told you he had been still frustrated by the mortgage assertion. He said he filed problems on the Individual Financial Protection Agency the new federal company you to manages individual lending as well as a tx condition agencies, each of hence ran no place.

Hearing towards large racial disparities into the Navy Federal’s financial approvals made him consider the financing connection was suppressing pros and their household of only beneficial by themselves, Otondi told you

CNN’s study will not prove one to Navy Federal discriminated facing one individuals. But it does tell you tall disparities throughout the borrowing union’s approval prices for consumers of various races and this has actually huge racial openings than many other highest financial institutions.