-

Money Their Mobile Family: The basics of Mobile Mortgage brokers

Money Their Mobile Family: The basics of Mobile Mortgage brokers - Brand of cellular home loans

- Qualifying to have a mobile home loan

- Finding mobile mortgage brokers

Associate links to the things in this post are from people one make up you (get a hold of all of our advertiser disclosure with these selection of couples for lots more details). Yet not, our very own opinions was our personal. Observe how i price mortgages to type unbiased critiques.

- Cellular, are made, and you can standard home is equivalent, but you will find trick variations which can change the investment your may use.

- Of several software require the the place to find features no less than eight hundred rectangular feet of living space.

- According to your role, a personal bank loan is generally a better options than simply a home mortgage.

Mobile homes try a better complement certain homeowners than simply antique households. You really have a reduced budget, wanted a smaller space, otherwise need to circulate the home after.

Sorts of mobile home loans

You really have several options for cellular lenders based the downpayment, credit history, and size of our home. The best fit might also go lower in order to if need a cellular, were created, otherwise standard domestic.

FHA money

You can aquire an FHA financing for sometimes a made otherwise modular house. You are getting so it courtesy a vintage bank, but it’s supported by the newest Federal Construction Government, the main United states Service out-of Construction and you may Urban Creativity.

There have been two form of FHA fund to own are built and modular homes: Name We and you will Label II. Term We money are accustomed to pick property although not the fresh new house it sits into the. The quantity you might borrow relies on which kind of assets you are to find, but it provides apparently lowest credit limitations. A concept We loan could well be recommended if you are coping with an inferior funds.

Term II loans are accustomed to get the home and you will brand new homes underneath. The house or property need certainly to fulfill specific conditions, instance having 400 square feet of living space.

Va finance

Finance backed by brand new Institution out of Pros Affairs (generally entitled Va fund) was for qualifying productive army members, pros, and their parents. You are able to an effective Va loan to shop for a produced or standard family.

You don’t need a down payment should you get an excellent Va mortgage, as well as the minimum credit score required depends upon hence bank you utilize.

USDA finance

You can utilize financing supported by the united states Agency out-of Farming to invest in a created or modular family. So you’re able to be eligible for a USDA financing, your house should have no less than 400 sq ft off living area, also it need to have already been constructed on otherwise once .

Just as in a beneficial Virtual assistant mortgage, there is no need a down-payment, in addition to credit score you need relies on the lending company.

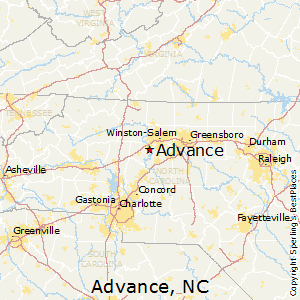

Note: USDA money try having belongings inside rural section, and you also need the lowest-to-reasonable money in order to meet the requirements. The most money level relies on where you live. You will find your county’s income limit right here.

Old-fashioned finance

The Fannie mae MH Advantage Program is actually for are created home. You will get a 30-year fixed-rates mortgage, which program also provides straight down interest rates on the are available home loans than you possibly might located elsewhere.

Need an effective step three% down-payment and at least an excellent 620 credit score. The house along with need to see particular standards – instance, it must be at least twelve foot broad and have now 600 sq ft out-of liveable space.

Freddie Mac computer likewise has funds getting were created belongings, and you will choose between a number of fixed-price and adjustable-price terms and conditions. Instance Federal national mortgage association, Freddie Mac requires the the home of see criteria. short term loans Umatilla Your house should be no less than twelve base wide that have 400 square feet away from liveable space.