-

Just before financial support the borrowed funds, lenders is thoroughly comment every third-group agreements

Just before financial support the borrowed funds, lenders is thoroughly comment every third-group agreements Loan providers may get ready for the possibility of a standard of the securing tasks of your own borrower’s agreements which have design gurus otherwise which have designers. They may be able additionally require project of every and all sorts of arrangements and you can compatible it allows over the construction.

Brain the newest Connecting Criteria

Abilities and you will commission ties are very important to possess structure finance. An informed efficiency bonds guarantee the package will be fulfilled just as previously mentioned. Which assures invention conforms on nuances out of criteria and plans. Most structure loan providers mandate a dual assist rider to possess ties you to definitely sooner turns the financial institution into the an oblige, making certain alot more determine throughout the transactions. Almost every other loan providers require a task of your ties to ensure that inside the function away from foreclosure they don’t really must receive the brand new securities to keep construction.

4. Stand Aware!

In the place of old-fashioned money for which you lend the money following observe the newest repayments have, framework money need a great deal more engagement. Loan providers have to pay notice at all level of mortgage since the fund will be presented call at pulls after the closure date. Like, lenders would be to wanted mark monitors, perform transparent and versatile costs, and construct rules which can be adopted.

Draw Inspections

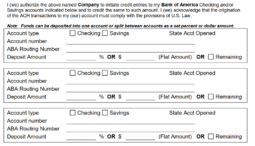

Dive profoundly for the borrower direct deposit loans in minutes review study up until the bank chooses to provide in order to a borrower is essential, but it is not where lender’s homework is avoid. That have construction financing, the lender will bring fund into debtor a tiny from the a great amount of time in brings. Such draws should be with draw checks where the financial otherwise ideally a 3rd party. Tilting toward a professional otherwise separate designer to run, or at least screen, construction website checks are mandatory. This designer otherwise professional ought to provide a completely independent review of the site to identify all-potential threats. This way, lenders understand people troubles early and certainly will function consequently.

Clear and versatile Project Finances

Private loan providers one just be sure to keep track of all the info about a prospective framework loan by using a beneficial solitary spreadsheet try destined to get wrong. Loan providers shouldn’t be frightened so you’re able to up-date throughout the complicated spreadsheets to helps management. In place of seeking to create spreadsheets, opt for app created specifically having construction financing government.

Perform Procedures and you will Follow All of them

Lenders is to manage formula and procedures for coping with certain facets of construction finance for example an approach to providing pulls. Shortly after function the insurance policy, lenders is to try to follow it religiously. They want to then file any deviation in the coverage but if from an audit and must look at all of them sometimes to be certain the exclusions was fair, sensible, rather than discriminatory.

5. Correct Files

Proper paperwork of your own loan and words is one of the finest a method to decrease chance. Loan providers will likely be certain to very carefully document just how the building set aside commonly mode and not restricted to the fresh new uses from the construction set aside, the newest management of the design set-aside, and requirements precedent so you can disbursements. The loan data files need to have a thorough gang of build defaults that will bring defenses into loan providers.

The new intrinsic likelihood of financing towards framework money is actually decreased from the playing with bank-friendly loan records. These is to meticulously explanation how the building financing will work and offer powerful safeguards. Lenders should consider crafting a set of specifications before carefully deciding to help you give for the framework funds.

Structure finance is actually naturally risky, nevertheless rewards shall be great. Lenders will be wanted good name and you may builder’s risk formula, wanted borrower money in order to limit the financial obligations, get projects so you can design-associated plans, listen up within the lifetime of the borrowed funds so you can exactly how and you can in the event the loans are utilized, while focusing toward best paperwork regarding conditions.