-

In this post, we are going to high light this type of loan possibilities if you find yourself bringing specific helpful advice into the navigating the complete to shop for processes

In this post, we are going to high light this type of loan possibilities if you find yourself bringing specific helpful advice into the navigating the complete to shop for processes Have you been considering buying your first family in the Tx however, worried about this new economic issue? Anxiety not! There are numerous applications accessible to to enable first time homebuyers. The state of Texas also offers some initiatives thanks to both the Institution out-of Homes and People Points (TDHCA) as well as the Reasonable Property Organization (TSAHC). You will have stories regarding Texans that have taken advantage of for example possibilities to get her homes properly. Now is a lot of fun to visit forth while making possession a reality!

Brief Conclusion

/bismarck-north-dakota-wiki-56a189ba3df78cf7726bd710.jpg)

- Texas also offers a selection of homebuyer assistance applications to aid very first-go out buyers purchase land.

- Homebuyers can enjoy loan solutions eg FHA, Va, USDA finance and a lot more.

- Resources are around for knowledge into to get procedure and you may effective stories away from Colorado homeowners can be found.

Facts Texas Homebuyer Advice Applications

To buy a house would be hard for first time consumers, specially when it comes to within the related down http://www.clickcashadvance.com/installment-loans-tx/houston/ payment and you can settlement costs. The good news is, there are many beneficial advice applications for sale in Tx which make gaining homeownership so much more doable by providing things like mortgage insurance advanced decrease otherwise tax credit. These effort off organizations eg TDHCA and TSAHC enjoys her advantages in regard to eligibility requirements that should be looked cautiously. This will help somebody discover you to definitely most suited on their financial predicament. In doing this, they might acquire all-potential resources thus helping them into its means into the obtaining what is labeled as element of brand new American Dream’.

TDHCA My Basic Colorado Family

The latest TDHCA provides several guidance applications getting homebuyers in Tx, like the My First Texas Home system. Which offers the opportunity to rating enough time-label mortgages having low interest and up so you can 5% out of down-payment assist that’s completely without appeal, this type of masters are available once they satisfy specific requirements like which have a credit history out-of 620 otherwise significantly more than and you can compliant to certain income standards based on state. Customers need certainly to complete an informative path specifically designed for them as well.

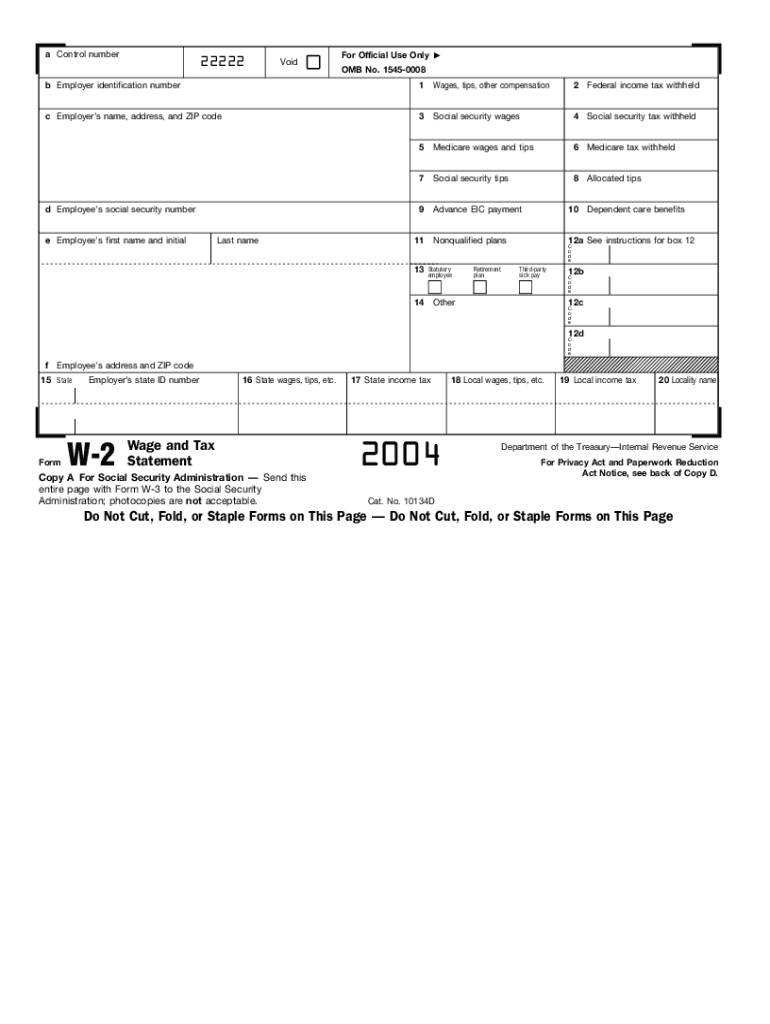

With this package become mortgage possibilities plus FHA financing, Va of these in addition to USDA resource and therefore all of the has actually closure prices services provided due to deferred zero-notice funds you might pay back whenever refinancing otherwise promoting the property/repaying the mortgage balance by itself entirely. It may be financially very beneficial to possess eligible first time consumers looking at to order land from inside the Colorado due mainly to this form away from recommendations on offer by the MyFirstTexasHomeprogram.

TDHCA My Selection Tx Domestic

The fresh new My personal Selection Colorado Domestic system is a wonderful option for people regarding Lone Star Condition, taking doing 5% of your own amount borrowed because the payment and you will closure prices advice. There is a thirty-12 months fixed rate mortgage with an intention rates lower than very on sector those qualifying from the 115% or below Town Average Family members Income (AMFI) could possibly get discover a lot more assist on their off payments. It allows financing owing to Fannie mae HFA Common antique money, which makes this tactic highly accessible for even recite homebuyers exactly who have seen fico scores off 620 or more just before get. Having versatile choice and financial aid out of this scheme, accredited customers now are able to afford home more readily within the Colorado!

TSAHC Loan Applications getting First-Time Buyers

The latest Texas Condition Reasonable Housing Company (TSAHC), in partnership with houses and you may people factors, has the benefit of a variety of valuable direction software specifically for first-day homeowners. One of many a couple no. 1 alternatives offered was Residential property getting Colorado Heroes and you may House Sweet Colorado Financial, each other offering down payment service to those one fulfill qualification standards. The former describes an initial time homeowner just like the just one or household members that maybe not had any possession stake for the assets in this the past three years. To begin through its program, its recommended be involved in TSAHCs qualification quiz before choosing off among their a number of accepted lenders. It will help secure a lot more preferable terms when taking out your brand new financing.