-

Historic Phoenix Districts A property When you look at the Downtown and Main Phoenix

Historic Phoenix Districts A property When you look at the Downtown and Main Phoenix The procedure of taking preapproved for buying property will be a little nerve wracking, particularly when you happen to be a primary-go out homebuyer.

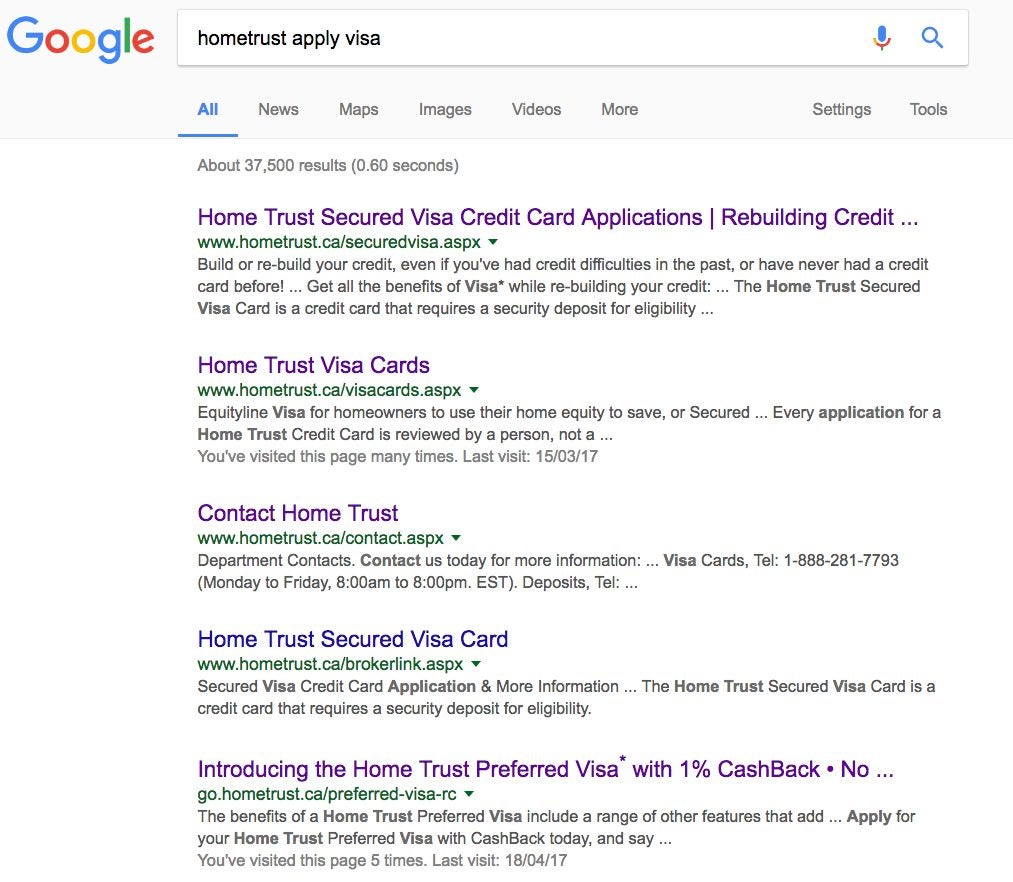

The first thing are selecting a home loan company otherwise representative. Excite realize my personal blog post, As to the reasons Rating Pre-Recognized for home financing as well as how Carry out I am aware Which Is the Right Lender For me personally?

To shop for a property might be a tiny nerve-wracking. My personal people and i also was here to hold your hand and you will make it easier to each and every step of way! We are all using every the newest technical readily available however, as well as love working the outdated-fashioned ways by the conference face-to-deal with. We’re going to help inside the any type of fashion most closely fits your position and you will wishes.

Once you have chose a lender, you might be willing to complete a beneficial pre-recognition app. My common lenders feel the application procedure on https://speedycashloan.net/loans/medical-school-loans/ the internet, or, you might meet him or her him or her personally if you need otherwise actually perform the app over the telephone. Anyway, might give facts about the sort of mortgage your search, your revenue, an such like.

Precisely what the Application Requires undergoing Providing Preapproved

This app demands you to definitely reveal their identity, tackles for a couple of age, birth time, social security number and you can functions background going back two years, and information about your bank account. Pre-approvals want a credit file for all borrowers.

The mortgage manager uses all the info considering into the mortgage software to acquire a credit report with about three credit reporting agencies. That it statement is analyzed by lender’s underwriter so that the credit direction try came across.

Your credit report comes with the financing ratings among almost every other essential bits of data. Credit history standards depend on the loan system taken out. The lender in addition to investigates your own payment records and you can checks to find out if there are one major borrowing from the bank things. Recent bankruptcy proceeding, foreclosures otherwise delinquent taxation liens is reasons why you should refuse that loan.

Normally, my personal prominent financial is focus on all your valuable pointers by way of an enthusiastic automatic underwriting techniques acquire an initial pre-recognition, however we nonetheless go after that.

The lending company will make you an entire list of brand new data (I call-it the bathroom listing) needed just after your fill out an application. Certain data are essential by the visitors, like this listing lower than however, extra data may be required based your own condition. Might, initial records you’ll want to render is:

Spend Stubs To own Money Verification If you are employed, the lender will need recent shell out stubs and sometimes W-2’s for the most latest one or two age. Lenders determine your own foot earnings and discover if any overtime, added bonus otherwise profits are often used to qualify for the mortgage. Loan providers also can require a-two-year reputation of acquiring earnings, overtime or incentives before you to definitely income can be used to pre-qualify for the mortgage.

Tax returns Anticipate offering the last two years of one’s tax statements. Various types of non-a position money, like attract and you can dividends, advancing years earnings and you will public defense income, require tax returns as well. If you very own a friends that files corporate tax returns, you may need to give people business efficiency, and people K-1’s, earnings documents such as for example a good W-dos or 1099 which might be granted for your requirements if the business try a collaboration otherwise S-Corporation).

Employment Confirmation This will be a summary of the employers to have the pat two years plus labels, contact and you can cell phone numbers.

Financial Comments You are needed to provide papers out of in which the new deposit and you may settlement costs are coming of. Widely known origin records is actually lender statements or financing statements. Of a lot loan providers do not allow money on hands (money remaining beyond a financial place) for usage getting an advance payment or settlement costs. In the event the a family member, company otherwise low-cash was providing something special or grant towards off percentage, you are expected to promote something special letter and you will facts your donor comes with the funds provide. Usually several months’ financial statements are essential.

Extra Records Based on exacltly what the documentation shows, you may have to offer details. Teachers are questioned to incorporate their a job bargain, simply because they are paid more nine, ten or one year, to make figuring the money of a pay stub alone hard. At exactly the same time, lenders could possibly get request you to describe high low-payroll deposits, lesser negative factors in your credit report otherwise a name variance. This is certainly well-known for ladies who alter their names once they elizabeth which have a daddy.

Self employment Records. In the event the relevant. Those people who are self employed may have to bring more or choice paperwork such as finances-and-loss comments, Government taxation statements and/otherwise harmony sheet sets for the past couple of years.

Disclosures The loan manager and you can mortgage lender just who underwrite your loan, when they independent organizations, are one another necessary to give you paperwork after you incorporate for a good pre-acceptance. Both the financing administrator and you will bank provides you with good Good-Faith-Guess, or GFE.

Which file teaches you the costs and you can regards to the borrowed funds your provides applied and you can been accepted for. Additionally be offered a copy of your own application and you may of numerous disclosures, and additionally notice of right to a copy of the assessment, maintenance disclosure declaration (shows just how many funds the firm has or sells) and also the Associated Team Arrangement (explains just what third-cluster companies are providing you characteristics). The loan officer keeps about three working days from your own software so you’re able to give you a great GFE, in addition to bank keeps three business days from the time it receives the application form to provide you with good GFE too. Really alter into amount borrowed, rate or terminology will require a different GFE be offered.

Achievement and you will Summation undergoing taking preapproved We have tossed numerous pointers in the your with this specific post. Therefore why don’t we overview some of the tips. Financial pre-recognition is actually something where in fact the bank critiques your financial record (credit rating, money, debts, etc.). This is accomplished to determine although you happen to be licensed for a financial loan. They’re going to along with inform you how much cash he or she is ready to give you.

Therefore, there’s a little bit of try to carry out initial and come up with yes you can purchase a home, however when it is over, we are able to focus on looking your your dream family. Feel free to call me each time getting a zero duty consultation.