-

HELOC, personal bank loan, otherwise mastercard. And this choice is right for you?

HELOC, personal bank loan, otherwise mastercard. And this choice is right for you? Trick takeaways

- There are lots of differences when considering HELOCs, unsecured loans and credit cards.

- HELOCs were gaining from inside the Delaware loans dominance as home prices has actually increased.

- Examining advantages and you will drawbacks out-of financing helps you dictate the leader.

You are planning to embark on a home renovation, purchase degree, otherwise help your house be eco-friendly with solar panel systems or greatest insulation. When financing is needed, it helps accomplish an abdomen-look at regarding which choice is suitable for your specific situation. But with so many choice on the market, how will you see which is right for you? Why don’t we get some good clearness from the looking into about three fundamental financing supply: HELOCs (domestic collateral credit lines), personal loans and you may credit cards. Immediately after doing some lookup, you can develop become well informed as much as the decision.

Which are the main differences when considering a great HELOC, personal loan and you will a charge card?

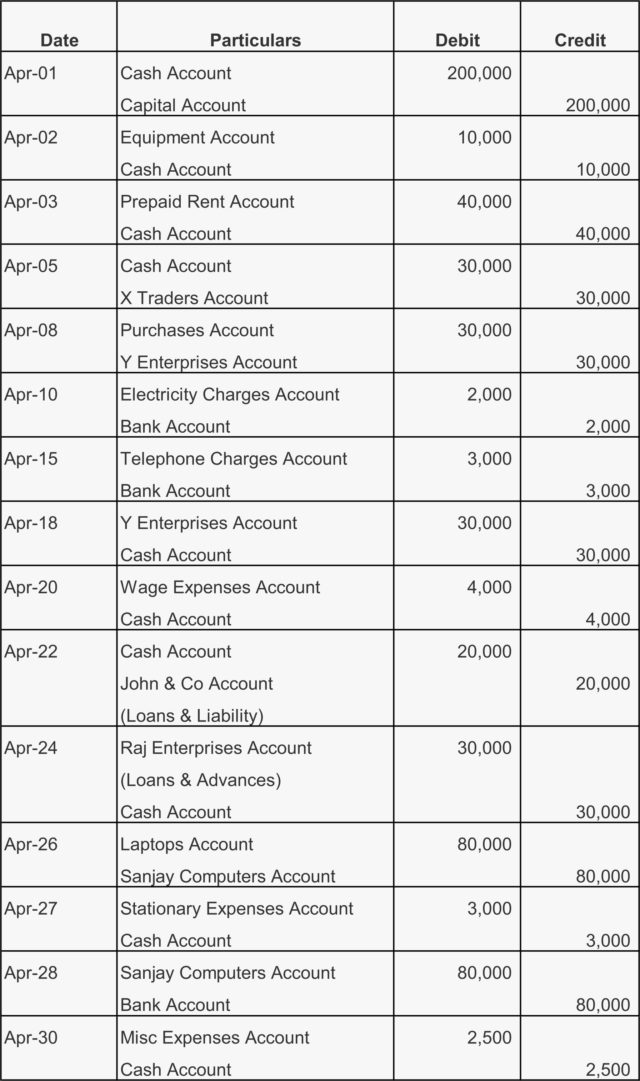

Specific head differences when considering a house guarantee line of credit, a personal bank loan and you may a charge card is actually interest rates, cost terms and conditions, charges and you can mortgage numbers. It assists to help you map out the fresh new formula of precise words inside for each and every choice when making conclusion that will apply at future goals. This is how the 3 style of financing fall apart:

HELOC: Good HELOC try a personal line of credit in which you borrow cash from the security of your house. You may have read your popularity of HELOCs might have been rising as well as home prices. A unique identity for a good HELOC is a second financial, and therefore basically locations a great lien on your own domestic. A general guideline based on how far guarantee will become necessary to track down good HELOC, it is 20%, although some institutions differ thereon shape. HELOCs usually incorporate lower APRs (annual fee cost) than simply credit cards otherwise personal loans, however, there can be yearly charges in it. So you can calculate how much guarantee you may have of your house, you just take the difference between the worth of your property and you can everything still are obligated to pay in your mortgage. Once you have calculated a complete quantity of guarantee, you ount. The mortgage-to-value (LTV) ratio is your most recent financing harmony split from the appraised value of your property. An enthusiastic LTV out-of 80% represents better by many financial institutions. It means they don’t allow you to hold financial obligation that is a whole lot more than 80% of one’s residence’s worthy of. Which personal debt boasts your existing home loan in addition to the brand new mortgage or credit line.

Personal bank loan: Which have an unsecured loan, you may be borrowing a specific lump sum of money which is then paid off more a determined time period, always anywhere between one or two and you will 5 years. Including, the speed is restricted. Signature loans is unsecured (definition your home is maybe not utilized just like the collateral because carry out end up being which have good HELOC) and can be studied for all the objective the latest borrower decides, in addition to combining obligations or within the cost of a huge expenses. Very, it’s to the fresh new debtor as to how they would like to utilize the loan.

Charge card: A charge card, approved of the a financial otherwise organization, enables you to borrow funds into the a going basis that have a good variable rate of interest to pay for merchandise or functions. If you don’t pay the expenses entirely per month, their left balance deal over. Brand new kicker? Mastercard focus tends to be greater as opposed which have good HELOC or personal bank loan.

To split anything down merely, why don’t we examine signature loans, home collateral personal lines of credit and you may handmade cards with a graphic. It might help you decide which option is suitable for their lifetime.