-

For Lead Funds taken in the UC anywhere between

For Lead Funds taken in the UC anywhere between Federal Paid, Unsubsidized and you can And additionally Fund can hold with these people loan charges that was taken off the primary in advance of disbursement. Thus, consumers find the complete of their loan disbursements ount borrowed.

Eventually, repayment is dependant on the brand new disgusting amount borrowed (perhaps not the online amount one loans Town Creek AL to makes up this type of charge). It amount is on their disclosure declaration sent to your just in case a different sort of mortgage is actually safeguarded. As well, that loan might have accrued focus when you begin repayment.

Origination charge was gathered to simply help pay for this new government off the borrowed funds software because of the You.S. Departments out of Training and you may Treasury. These types of costs are similar to processing fees have a tendency to connected with user funds.

Getting Direct Finance once

Direct Financing with their very first disbursement on otherwise immediately after , have an easy origination percentage. Lead Subsidized and you may Unsubsidized Financing provides a 1.0% origination payment. Direct In addition to Financing (to have moms and dads or graduate pupils) possess an excellent cuatro.0% origination commission.

Sequester

As a result of the authorities sequester that went towards the influence on , mortgage origination costs to your the fresh new federal loans first disbursed (taken to UC) enhanced slightly. Once again, this is simply for the the finance disbursed the very first time towards or just after . Percentage rates which might be go out-specific affect allowed, mortgage grows otherwise mortgage techniques completions afterwards about informative 12 months.

* With regard to complete disclosure, lower prices for a loan first disbursed just after Oct 1 is also conserve the latest borrower costs. Yet not, the lower price once , means 11 dollars from inside the cheaper costs toward a $5,five-hundred student loan and 80 cents into the good $ten,000 As well as Mortgage. Called for rounding of one’s fees in order to entire bucks by Service of Training may result in simply a modest (if any) adjustment on the financing. Individuals which intentially impede finance until shortly after Oct step one for financing percentage decrease have tuition costs owed just like the arranged to eliminate later charge.

UC switched into the Lead Financing system this year-eleven. Direct Paid and you can Unsubsidized Finance had a 1.0% origination percentage charged with an excellent 0.5% at the start interest rebate. Thus, college students experienced just a good 0.5% percentage subtracted throughout the disgusting loan amount during this timeframe.

Direct Mother and you can Scholar In addition to Money got good 4.0% origination percentage with an in advance attract rebate of just one.5% leading to simply a 2.5% cures from the lent count.

Student otherwise mother borrowers who neglect to create into the-big date money when the fund come in cost risk acquiring the at the start notice rebate for all Direct Financing additional right back onto its idea loan balance.

To own Loans Ahead of

Loan providers was basically permitted to charge a keen origination fee to simply help defray some of the will cost you off loaning currency whenever payment could be delay for quite some time. Restrict fees were put because of the legislation. The three% limit was in perception to own Government Together with Fund, but Government Stafford Money saw annual decreases on limitation down to a 1% commission in ’09-ten.

Revelation Statements

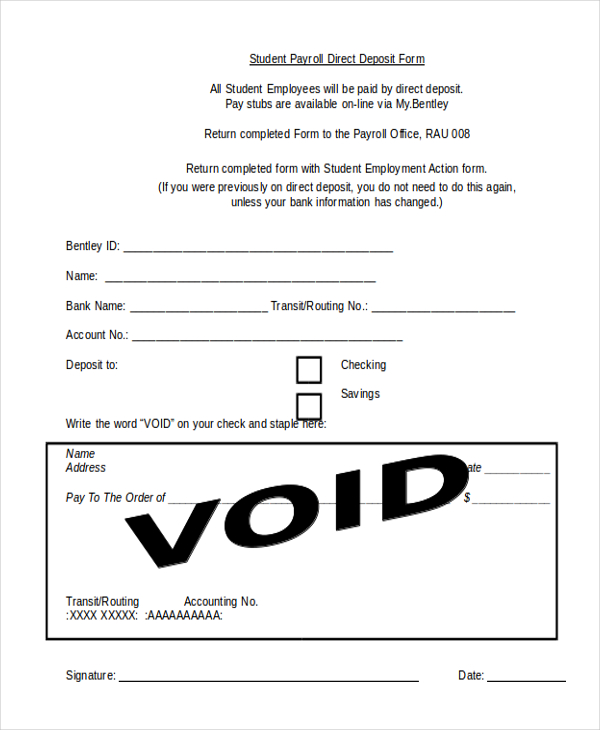

With each the newest financing covered on your own identity, a disclosure declaration try awarded you to definitely traces terms of the mortgage, number, charge, and disbursement schedules. Cautiously opinion and continue maintaining this type of comments to raised understand your loan and one fees removed until the finance was provided for UC in your title.

Estimating Financing Quantity

When estimating amounts to have Federal Head Funds, you will want to estimate exactly the same way the fresh recharging system usually assume semester mortgage quantity.

Grab the overall (gross) loan amount approved in your award promote and you can subtract step one.062% (otherwise step one.059%, if the loan accepted just after October step one) off of Subsidized and you can Unsubsidized Money and you may 4.248% (or 4.236%, if financing approved once Oct step 1) away from Mother and you may Graduate Also Funds to help you be the cause of each other origination and you can default fees. Upcoming separate that it internet amount borrowed of the amount of mortgage payments (constantly dos because so many funds is actually for the 2-label educational season).

Of the estimating these types of charges, it will be easy to higher enjoy any remaining balance one should be protected whatsoever help is actually used into the bill.

Considering the progressing changes in origination charge you to are present mid-season, a payment estimate ount but that difference can be limited.

Usually recheck your bill following financing posting to your account to be sure people numbers owed was paid-in a quick fashion