-

Finding the optimum loan terminology, prices, costs, and you will funding big date is going to be challenging regardless of your credit score

Finding the optimum loan terminology, prices, costs, and you will funding big date is going to be challenging regardless of your credit score Here is how every one of these issues may affect your own borrowing from the bank sense-and how to enable you to get the best possible terms and conditions to possess the loan.

Pricing

Rates is the most significant sign out of financing cost, very researching the choices is important. You to definitely device in your collection was checking the Apr prior to commercially obtaining a loan.

Of a lot lenders provide individualized costs that have a silky borrowing inquiry, that allows you to definitely contrast pricing rather than ruining your score by way of a hard borrowing remove.

It is not the case for all lenders, very discover which type of borrowing query the financial institution works before submission your information. Together with, prepare to help you upload documents, such as for example pay stubs, to ensure your information. Their speed otherwise recognition you certainly will alter in the event your bank cannot be sure things.

Terms and conditions

It’s prominent observe terminology private financing extend regarding two to six age https://paydayloanalabama.com/hobson. If you get multiple choice with different repayment terms and conditions, keep in mind the full cost of that loan may differ in accordance with the duration of the fees plan.

A longer title setting a lower life expectancy monthly payment, but you will spend a whole lot more focus. The alternative holds true for a smaller name.

Brand new dining table less than shows exactly how financing terminology impact the monthly premiums and you can full notice expense having a beneficial $10,000 loan having a % APR:

An element of the commission having home improvement funds try a single-big date origination fee. Origination fees can use to every borrower, just people who have bad credit (but your fee might possibly be highest predicated on your credit score). The official in which you reside and additionally affects your own origination fee.

An enthusiastic origination payment can make your loan cheaper, not. A loan provider giving a diminished interest might costs increased origination commission to cover the business costs. Particular loan providers grab the fee outside of the dominating balance on origination, although some include it with your repayments.

Consumer evaluations

Also, have a look at whether or not we keeps analyzed the firm. I search of many aspects of signature loans, in addition to just what consumers state, and we simply take satisfaction within the giving objective personal loan analysis so you are able to the best decision for the profit.

Home improvement loan application process

Many of today’s loan providers give on the web applications you can done in a couple of minutes. In addition to this, of many is going to do a softer query, providing you with smart regarding the matter you are able to qualify for along with your rates as opposed to take your own borrowing. This is how it really works:

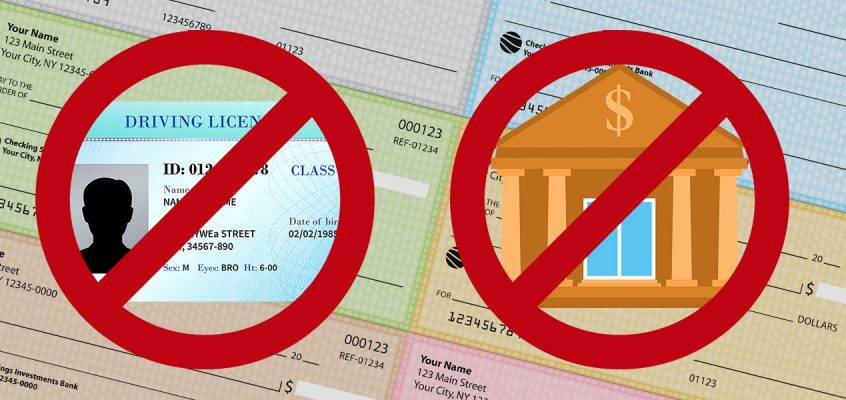

- Assemble the proof money and label. Having data files such as your We.D. and you may pay stubs ready before applying will save you date that assist you earn a decision less.

- Prequalify towards the lender’s web site. Checking the pricing online usually merely takes a couple of minutes. You are able to enter in recommendations just like your name and address, and also the last five digits of your own Personal Safeguards amount. You can also have to state just how much we should borrow and just how you’ll use the loan.

- Get a hold of financing option. The bank may provide you with one or more mortgage provide. Imagine for each and every your costs and terms, and use our very own commission calculator to compare borrowing can cost you. When you’re ready, purchase the option one most closely fits your position.

- Commit to a painful credit score assessment. Prequalifying simply concerns a smooth remove, but when you propose to complete a full app, you will have to agree to a painful credit check before you can be just do it.

- Promote income and you can term verification. Within this action, you’ll offer even more thorough information, such as your full Social Coverage amount. Additionally publish the files you attained before. This action is often the longest step, based on how of many data you should upload incase you currently have all of them conserved electronically.