-

FHA Online calculator: Look at your FHA Homeloan payment

FHA Online calculator: Look at your FHA Homeloan payment FHA mortgage brokers require simply twenty-three.5% off and they are ultra-easy to the credit ratings and you can a position history than the most other mortgage models.

The first step so you can viewing when the FHA can make you good homeowner will be to run the fresh amounts using this FHA mortgage calculator.

The way you use an FHA finance calculator

Once you shell out their home loan, you aren’t merely repaying financing principal and you may desire for the financial. You also need to blow home insurance, property fees, or any other related will cost you.

The newest FHA mortgage calculator significantly more than lets you guess your true’ commission whenever all of these charge are included. This should help you score an even more direct count and you may figure aside just how much home you could potentially extremely afford which have a keen FHA mortgage.

We have found a breakdown so you’re able to discover each of the terminology and you may costs found in our FHA financing cost calculator:

Down payment

Here is the dollars amount you devote for the your residence get. FHA possess the lowest deposit minimum of twenty-three.5% of the cost. This may come from a deposit current or a qualified downpayment assistance program.

Loan label

This is basically the fixed timeframe you pay off your home loan. Really homebuyers choose a thirty-seasons, fixed-rate financial, with monthly payments over the life of the mortgage. 15-seasons fixed-price loans can also be found through the FHA system.

FHA offers changeable-rates mortgages, too, even when talking about much less common as the financial speed and commission can increase inside financing name.

Rate of interest

This is basically the annual speed the home loan company fees because the an effective price of borrowing from the bank. Mortgage rates was indicated while the a share of one’s financing number. Such, if the loan amount is $150,000 along with your interest rate are twenty-three.0%, you’d spend $4,five hundred for the appeal during the first 12 months (0.03 x 150,000 = 4,500).

Prominent and you may attract

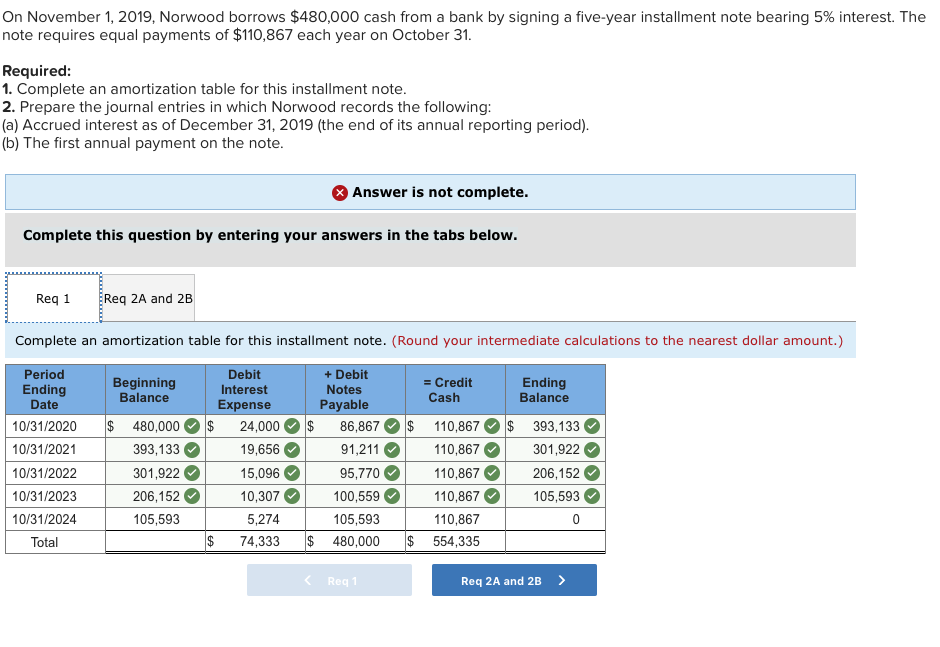

This is actually the amount you to definitely goes toward paying down your loan harmony as well as desire because of your home loan provider each month. So it remains constant into the life of a predetermined-rate financing. Your own month-to-month mortgage payment does not transform, however, every month you pay even more inside the dominating much less in the attract before amount borrowed is actually reduced. So it fee progression is known as amortization.

FHA financial insurance

FHA demands a fee every month that is kind of like loans Bonanza Mountain Estates private financial insurance rates (PMI). It percentage, titled FHA Financial Premium (MIP), is a kind of insurance rates one to handles lenders against reduction in matter of a foreclosure.

FHA fees an initial home loan top (UFMIP) comparable to 1.75% of the amount borrowed. It is rolled to your loan harmony. Moreover it fees a yearly financial insurance premium, constantly equal to 0.85% of loan amount. Yearly MIP was paid in monthly payments together with your mortgage payment.

Assets income tax

The fresh county or municipality where the residence is receive charge a specific amount annually during the taxation. This prices was divided in to 12 installments and you may accumulated each month along with your mortgage repayment. Your own bank gathers so it commission because state can also be seize good family in the event the property taxes are not repaid. The latest calculator estimates property taxes according to averages out of taxation-prices.org.

Homeowners insurance

Lenders require you to ensure your residence from flames or other problems. Your month-to-month home insurance superior try gathered with your mortgage repayment, while the financial sends the fresh payment on the insurer for every year.

HOA/Almost every other

When you find yourself to buy a flat or a home during the a Structured Unit Advancement (PUD), you may have to spend people relationship (HOA) dues. Mortgage officers reason for this rates whenever deciding your own DTI rates. You may also enter in most other home-related fees for example flooding insurance policies on earth, but never include things like electric will set you back.