-

Exactly what are the dangers of using home security?

Exactly what are the dangers of using home security? You’ve based particular guarantee in your home. Today you’re interested in tapping it to acquire dollars that will make it easier to renovate, invest in a small business, otherwise repay student education loans.

It goes without saying, and you’re not alone. Rising home values enjoys determined equity so you can historic highs. This, consequently, provides assisted push a sharp escalation in household guarantee capital. According to TransUnion, domestic equity personal line of credit (HELOC) originations improved 41% from the 2nd one-fourth out-of 2022 as compared to next quarter from 2021. Originations away from domestic collateral fund enhanced 30% during the same several months.

But just because you can make use of household collateral cannot always mean you should. Scraping your residence’s equity form entering into obligations together with your family as the collateral, which means that trying to repay your own lender that have notice. This reality are top out-of attention regarding your property equity solutions and you can deciding in case it is really the most practical method in order to obtain the funds you want.

Tapping your house security as a result of property security loan, HELOC, otherwise dollars-away refinance has some risks. You can get rid of your home for those who fall behind in your payments. For folks who faucet a high portion of your equity plus house’s worth drops, you can belong to a bad collateral condition (labeled as becoming under water). This could enable it to be difficult to sell your residence. An excellent HELOC otherwise bucks-out re-finance possess a variable interest rate. So if cost rise, your fees count usually go up too.

Therefore will it be a smart idea to tap house equity? This will depend in your psychology, your financial predicament, and just how you intend to utilize the financing.

Is-it best for you personally to make use of their home’s collateral?

Whenever of course, if people debt, we wish to have fit individual financing activities, like the element (and a plan) to invest back one obligations punctually. You want to always do not have other realistic, lower-cost way to finance your preparations, along with saving a little more money and only purchasing having dollars. And it is better to limit your family equity so you’re able to uses you to can give a positive profits on return, instance enhancing the value of your property or boosting your getting potential.

When the these types of comments use, a house equity mortgage, HELOC, or cash-away Greeley money loans re-finance could well be good for you. Let us discuss a number of the popular methods for you to use your home guarantee, and lots of of your items we would like to envision whenever determining if or not talking about a good idea.

Using family guarantee for renovations otherwise significant solutions

Home owners have the option to utilize domestic equity for an option out of home improvement and fix ideas. These are typically doing a cellar, growing living space to possess an expanding nearest and dearest, otherwise modernizing a kitchen area.

Considerations to remember: Prioritize strategies you to definitely enhance your house’s worth or address vital solutions in order to maintain its sector well worth. Take care of an emergency fund having regime maintenance and you may unexpected service costs. Certain renovations, for example opportunity-successful improvements such solar panels, can get qualify for taxation credits. Consult an official taxation elite to own in depth advice.

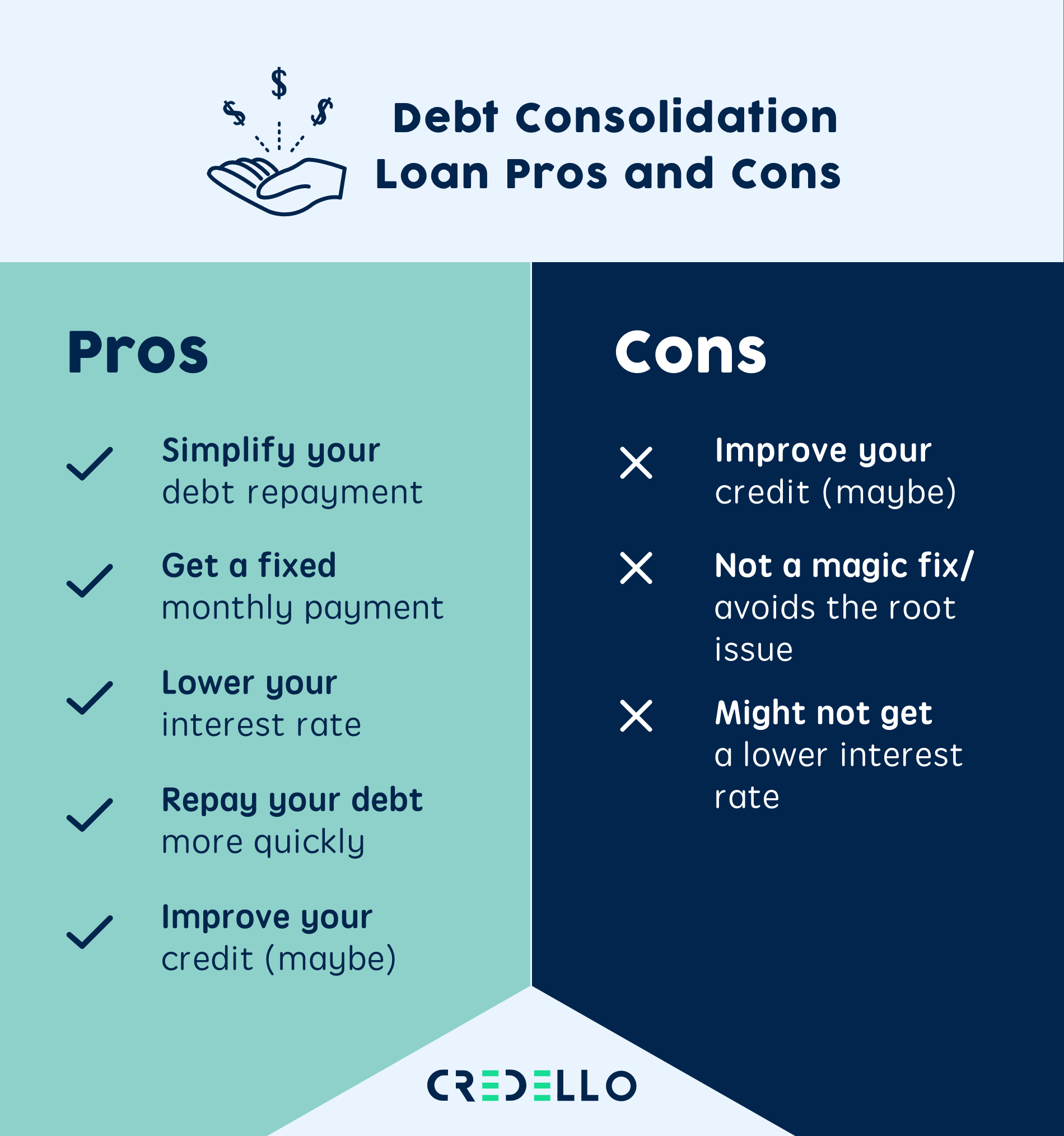

Combine personal debt or pay-off present student loans

Credit debt are back again to pre-pandemic levels. Centered on Equifax, full card stability regarding U.S. strike $916 mil when you look at the membership.

Luckily for us, you need house collateral to consolidate high-interest personal debt such playing cards otherwise student education loans. By the consolidating higher-attract debt so you’re able to a house equity loan, HELOC, or bucks-away re-finance, you need to look for significant savings from inside the down interest levels. Combining can also clarify debt life: in place of paying off multiple handmade cards and you will money, you should have only a single, monthly payment for the lending company.