-

During that composing 29 says features often then followed otherwise try adopting Rate software (and additionally Champion loans)

During that composing 29 says features often then followed otherwise try adopting Rate software (and additionally Champion loans) A lot more like VILLAIN financing. Here is what You will want to Look out for-Might Both Slow down Their Package, Eliminate Your Contract otherwise Tough…

Everyone loves the latest champion, proper? I envision a knight in shining armor operating with the arena protecting the new damsel in the distress. Not? While i first heard about Hero loans, We related my personal attention out of a character which have Character due to the fact I am aware they need us to. However they are away from Champion fund he is a lot more like VILLIAN finance black, shady letters would love to inexpensive from your own pouches, blow up your loan, if not tough, give you dump several thousand dollars.

Under the Income tax Exclusions portion of the PTR a character financing was indexed

Simply 2 for the article we’ll tell you a bona-fide-lives Hero financing and situation and everything should do to include your self and/or the consumers from these villains.

Hero stands for House Times Repair Opportunity (HERO). It belongs to the house or property Assesed Clean Opportunity System (PACE) system that provides investment to own opportunity-productive, renewable energy things in order to communities generally speaking. Come across graph lower than wherein claims.

In the most common claims, Champion finance was issued by the condition bond laws and regulations. How much does which means that? In short and you will simplified words, it means these types of financing have a similar priority as property tax- es. That means that he’s much better than the latest liens given by mortgage lenders. Thus, inability to spend such liens leaves all of the liens junior in it (the investment regularly air-conditioning- quire the brand new attributes in the most common issues) on the line.

In its Promoting Guide awarded , Federal national mortgage association says that it’ll maybe not purchase people Speed mortgage that will not using so you’re able to its mortgage. Freddie Mac states the exact same thing. Because the most of the money are basically pre-offered so you’re able to Fannie mae before financial financing, so it effortlessly slams the doorway toward conventional financing for Character money as opposed to such as for instance sandwich- ordination. FHA won’t finance also without sub- ordination.

We are going to talk about Character/Speed money in detail, why are him or her constitutional, how they are put up, exactly what your dangers might be, and you will what’s going on available

Sure loans Moodus CT, there are arrangements and you can element to have Hero money to be subordinated meaning that succeed a good GSE lien to stay place. Yet not, as the latest while the last year there are complications with Fannie mae and you will Freddie Mac acknowledging HERO’s subordination vocabulary.

Regardless of, there is certainly a particular chill into the transformation procedure for an effective house. Representatives should expect an extended DOM to possess a property due to the new Champion financing. Then, since GSEs dont al- lower HEROs included in Examination, they have to be as part of the CLTV of the property.

In which is a buyer change? Where can a borrower change? Perhaps so you’re able to choice low-lender loan providers otherwise private money lenders. Although not, getting good LO who wants to romantic a loan, so it effortlessly will get a frustration and a prospective low-beginner for them. Finest situation scenario there are other hoops so you can diving through to have brand new debtor to close its loan.

1. Obtain the PSA / Loan application to check out When the a champion are Disclosed. Looks noticeable. Remark the acquisition agreement or application for the loan to discover if an effective Hero is actually expose on the contract. Whether it wasn’t, you then still need to examine an extra set, however, about you really have an indication that you can not get on here.

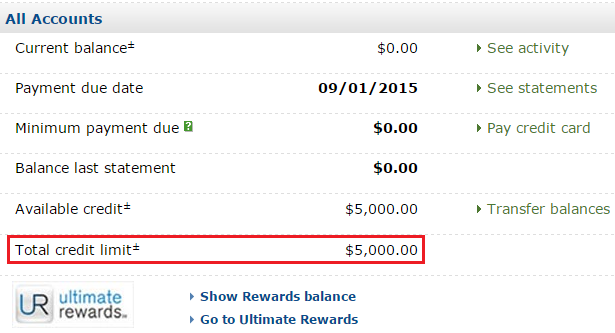

Rating a great PTR as fast as possible and you can remark they. Inside the California, for instance, brand new title of your Hero financing generally is Find out-of Review and you can Fee out-of Contractual Review Required. It may be called something different and can generally speaking feel correct ahead of, at the, or after the unique assessments disclosure about PTR. In case it is around, you then see you have got a character you will want to put!