-

Chance assessment is a lot like credit rating and you will chance rating

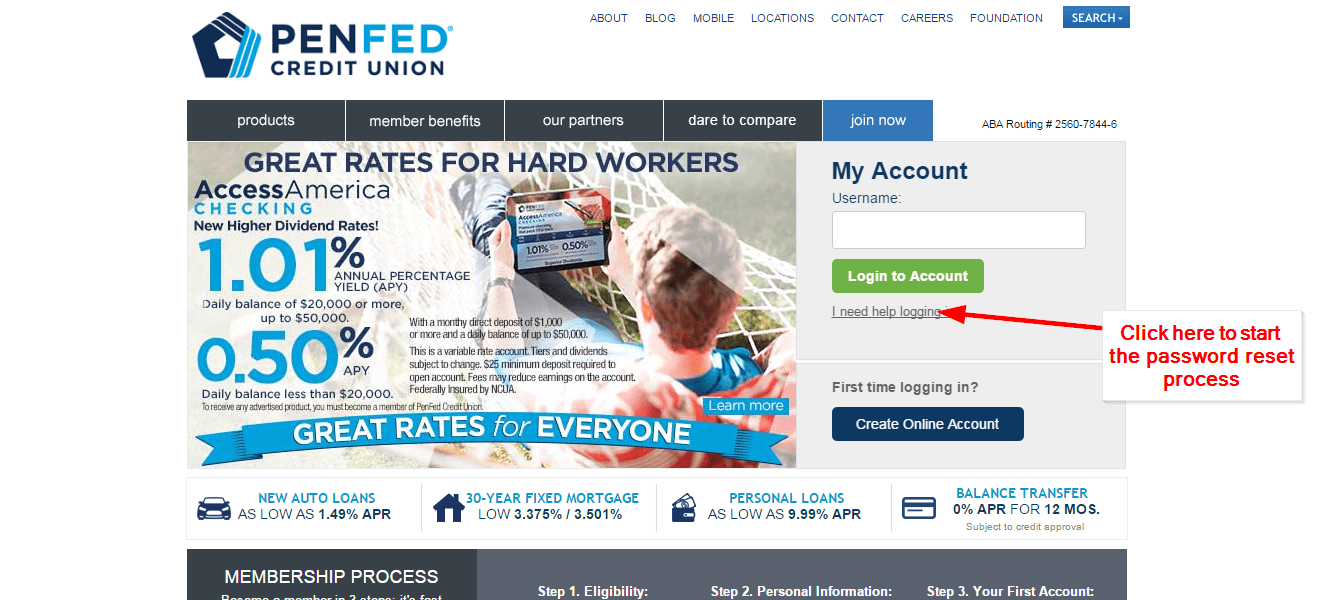

Chance assessment is a lot like credit rating and you will chance rating Correct away from rescission – A supply of one’s Facts inside Lending Operate that provides an effective borrower the ability to rescind a credit transaction (we.elizabeth., changes their unique head) inside three working days on one purchase where the prominent residence is regularly contain the mortgage.

Chance review – The new measures a lender employs in contrasting a good borrower’s creditworthiness, cost element, and you can security updates in accordance with the fresh new borrower’s implied utilization of the loan proceeds.

Exposure advanced – Brand new here improvement away from a lender’s base interest rate in response so you’re able to the new forecast level of a great borrower’s borrowing from the bank risk.

Its mission should be to end a lot of experience of borrowing danger of a single debtor

Chance rating – This new relative amount of borrowing exposure of that loan purchase. The financial institution can use credit rating otherwise chance analysis measures so you can view loan requests and you may category individuals to the some risk categories to own reason for loan greet otherwise getting rejected, mortgage prices, loan handle, amount of overseeing and amount of loan files.

Defense agreement – A legal software finalized by the a borrower giving a security interest to help you a lender inside the specified individual property sworn as the security in order to secure that loan.

Higher risk financing will demand a much bigger modifications to the price differential symbolizing the risk superior

- Blanket safeguards contract – A safety need for favor of the bank coating the chattels.

Higher risk money will need a larger modifications toward price differential representing the chance superior

- Insolvent – Obligations are more than the worth of the latest possessions.

- Solvent – The worth of this new assets are greater than liabilities.

Inventory criteria – A method to capitalizing financing organizations for instance the collaborative Ranch Credit Program. New borrower is required to purchase inventory in the financing relationship to acquire financing. The latest stock criteria generally is specified given that a percentage of one’s mortgage otherwise just like the a money count. The newest inventory requisite may be a reduced while the 2% of your own worth of the mortgage otherwise all in all, $step 1,000. The acquisition from inventory try an investment regarding the issuing business that is typically paid down at the loan readiness, although lender isnt obligated to do so.

Insights inside the credit – The newest federal Basic facts into the Financing Operate is meant to to ensure a good important disclosure away from borrowing from the bank terminology to help you individuals, especially towards individual financing. Loan providers have to change consumers correctly and you may clearly of the overall level of the loans charges which they need to pay and this new annual payment rate of interest toward nearest .01%. Excluded transactions are loans having commercial otherwise company objectives, together with agricultural loans; fund so you’re able to partnerships, business, cooperatives and you will company; and you can finance more than $twenty-five,000 apart from manager-filled, home-based a residential property mortgage loans in which compliance required long lasting matter.

Greater risk fund will require a much bigger modifications with the price differential symbolizing the risk premium

- Debentures – Ties that aren’t secured of the possessions out of a company.

- Non-revolving credit line – A line-of-borrowing where restriction number of a loan ‘s the overall out-of loan disbursements. Money do not create financing financing available again like in a revolving line of credit.

- Moderate rate of interest – The genuine interest rate quoted from the financial loan providers while others.

Judge credit maximum – A legal limit into total level of fund and you may commitments a lending institution have a good to any you to definitely borrower. This new restrict usually is set since the a designated portion of the latest financial institution’s individual web worth otherwise guarantee financial support.

Greater risk loans requires a larger improvement into price differential symbolizing the danger superior

- Balloon mortgage – Loans with periodic repayments in identity of the financing, on remaining amount owed in the maturity (prevent of your own financing). Costs from inside the longevity of the borrowed funds get put merely focus otherwise notice many portion of the prominent. Brand new balloon percentage is the final payment from a balloon loan possesses the brand new outstanding equilibrium, and therefore ount.

Fees feature – This new envisioned feature of a borrower generate sufficient cash to pay off financing also desire according to terminology created in the mortgage bargain.