-

Carry out Credit Unions Give Funds for example Financial institutions Do?

Carry out Credit Unions Give Funds for example Financial institutions Do? Whether it is to possess a crisis or even pay for your own expenses, unsecured loans will likely be a lifesaver for almost all Canadians. not, the general belief is that you can just rating legitimate personal fund about larger banking companies and large creditors. But financial institutions aren’t the only or the most useful monetary organization to truly get your 2nd loan.

One benefit off making an application for financing from an effective borrowing connection particularly Creativity is the fact the loan was individualized to your role. You desire a loan quick? You could pertain within a few minutes. You need versatile percentage choice? they are offered. You could generate profits dividends on your loan thus you happen to be indeed making a profit when you find yourself borrowing from the bank money.

Borrowing from the bank unions are user-had plus don’t benefit from getting its users when you look at the disadvantageous ranks on account of a consumer loan. Therefore, they’ve been inclined to supply you that loan that’s true to suit your problem hence makes up about any potential downfalls one to might develop in repay process.

Can i get a cards commitment financing to spend mastercard loans?

Why would some one pull out a consumer loan to pay off credit card debt? The key reason was debt consolidation reduction. Debt consolidating is the work regarding swinging your debt in order to one set making it cash advance CO Eads more straightforward to track and you can perform. Others bonus off taking right out an unsecured loan is that the interest prices into the finance are lower than the new rates for the a credit card. Credit unions instance Invention can often give higher interest rates and versatile commission possibilities that make paying down the debt far smoother.

So now you understand why you may want a consumer loan, however, should you get that? The first step would be to query for individuals who qualify for an effective unsecured loan. Which have a good credit score and you can power to acquire usually significantly improve likelihood of bringing a consumer loan.

Furthermore, you prefer a consumer loan big enough to cover your credit card debt. Or even, you are going to need to pay a couple of funds from at the the same time frame. Could you be eligible for the loan number you prefer?

While the latest question you ought to imagine is is it possible you features a technique for paying your mortgage?

In case your answer is yes for the significantly more than, you’ll almost certainly make use of taking out a cards union loan to pay off their credit card debt. However, if you might be still unsure, contact us for more information.

Who will be the best providers to possess quick funds from inside the Canada?

You believe larger financial institutions provide higher quick financing choices for Canadians. He is a trustworthy resource and supply the means to access in-person or over-the-phone customer support.

You may want to be turning over an online bank or bank. Many on line associations promote most useful costs than its larger financial alternatives and get way more options with regards to the mortgage count.

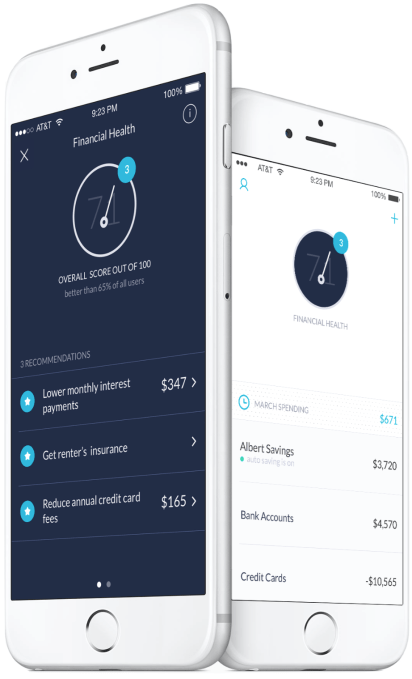

Advancement, not, is among the finest providers from signature loans. The applying process is fast, and you are offered many versatile commission possibilities very you are not trapped with a loan you simply can’t pay-off. And, the service has actually a personal contact you do not discovered regarding most other creditors. Therefore earn profit sharing cash by just with a loan around.

Exactly how ‘s the full focus towards the a consumer loan calculated?

When taking away a loan, you are charged an interest rate. Activities like your credit history and you can amount borrowed will be different the eye you are recharged.

You should use a finance calculator to determine how much complete notice it’ll cost you on the unsecured loan.

Learning Credit Partnership Finance

Ensure that you investigate just what rate of interest and extra benefits a monetary business is offering before taking away a separate personal bank loan. Along with, ask yourself if this company features your absolute best need for head or is simply attempting to make money away from you.

By using these expected strategies and you may shop around, you’re sure to obtain the credit procedure basic of use.