-

Beyond a skilled realtor, finding the optimum home loan company is crucial

Beyond a skilled realtor, finding the optimum home loan company is crucial With a specialist home loan cluster, i master the real nuances of one’s Greater Chi town construction scene, therefore the actually-switching locations

Chicago’s charm is undeniable, featuring its steeped background, renowned tissues, and diverse communities. While you are desperate to succeed your house by buying a home otherwise condo regarding Windy Town, you are most certainly not alone. Chicago customers can take peace and quiet about simple fact that mortgage loans aren’t of up to what exactly is knowledgeable because of the other locations, particularly Nyc and you will La.

Financial people tend not to work with your own geographical area when deciding their rate. For this reason, Chi town homebuyers can go to the home loan web page to view the fresh new current cost. not, just remember that , the specific mortgage you’re given would be influenced by:

- The particular regards to the loan – The sort of mortgage you pick has an effect on their financial rates and you may simply how much you only pay every month. Fixed-rate mortgages have regular payments but you’ll begin by quite highest rates. Adjustable-price mortgages (ARMs) will start having down cost, nevertheless they South Carolina personal loans can alter later on, and work out your instalments rise. Along with, if you choose a shorter financial, you may get a diminished rates but i have to invest a whole lot more per month.

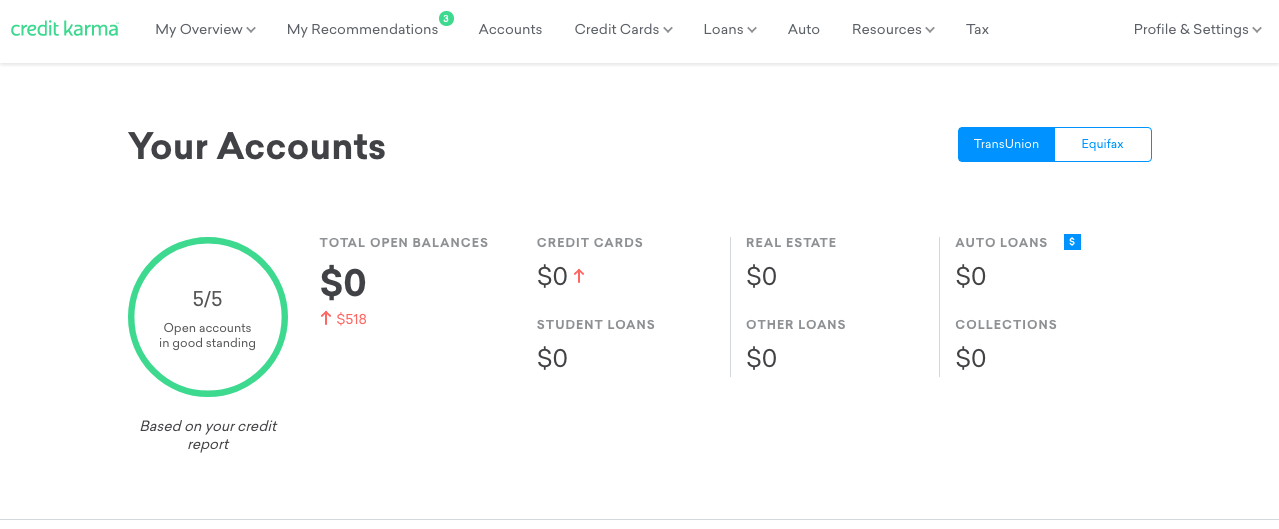

- Your credit rating – Your credit score shows monetary fitness, encapsulating your early in the day financial conclusion in addition to their feeling. Punctual debt government is also elevate your get, when you are one waits is also impede it. Chi town owners looking to favorable home loan costs will be focus on the absolute minimum get out of 620, even when loan providers usually choose ratings exceeding 740. While struggling to replace your get, discover Get to know (and boost) your credit score.

- Debt-to-income proportion – il mortgage lenders very carefully feedback the debt-to-income proportion to understand in the event you could logically manage the loan whereby you may be inquiring. They will cause for most other fund, credit card bills, and you may continual costs including child support. Ideally, the joint obligations will be only about 42% of your income; some thing large might cause your mortgage lender to suggest you straight down your to find finances.

- How much cash you devote once the a deposit – It’s really no secret that the measurements of your own deposit affects your monthly premiums. Bigger down money imply you borrowed from less money, ultimately causing lower monthly payments. Although not, il home buyers who aren’t acquainted with the procedure is generally unaware whenever they don’t spend 20% of one’s residence’s price upfront, they might need to also consider private home loan insurance policies (PMI) within their monthly payments.

Lender of Vow has arrived to aid il home buyers talk about possibilities and pick the mortgage you to aligns better along with your monetary expectations. We’re going to discuss tips rating the best home loan costs, this new financial advantages and disadvantages of various assets items, and how the loan and you will new house can be go with your own complete long-name fiscal preparations.

Financial companies instance Financial of Pledge, with the deep understanding of Chicago’s ics, is actually invaluable allies inside the securing customized fund

I few the options having very first-rates support service, which means you are going to discovered personalized suggestions tailored towards the novel demands and you may requires. The team’s knowledge assures you will be making told decisions, securing the right financial provider for your Chicago property trip.

Good news having Chi town owners-Providers Insider finds out the average financial rates when you look at the Illinois is actually well below more says. On $1,804, Illinois’s average is surpassed by DC, pshire, Oregon, Rhode Isle, and you may Virginia, just to term several. However, it is worth accepting you to definitely Providers Insider’s conclusions is actually statewide, and therefore il homeowners could possibly get deal with steeper mortgage payments than simply if it available in the rest of your own area.