-

An educated Lenders to possess Lower-Income Solitary Moms and dads

An educated Lenders to possess Lower-Income Solitary Moms and dads When you’re a single mommy way of living toward a limited money, you’ve got choices which can help make the think of homeownership possible. Lenders to have low-income single parents consist of authorities-backed home loan possibilities like FHA finance and USDA finance. When you’re struggling on a single earnings, you can also be eligible for down-payment guidelines that helps your spend less to put off whilst fulfilling your own along with your infant’s need.

- A knowledgeable Lenders to possess Lower-Income Single Moms and dads

- FHA Financing

- USDA Money

- Get a hold of All 20 Factors

Government-recognized real estate loan choices are popular mortgage brokers for solitary mothers while they enjoys lower down commission and you can borrowing conditions. Government-supported mortgages possess insurance coverage off certain twigs of your government bodies, and therefore lenders may offer all of them looser qualification requirements in comparison to help you antique funds. A few of the most preferred alternatives for single mothers toward a beneficial tight budget to locate an interest rate tend to be:

FHA Fund

FHA fund is actually backed by brand new Federal Construction Management, that is the main Agencies from Homes and Metropolitan Innovation (HUD). The greatest appeal of using an FHA financing as a great home loan choice for solitary parents is the down payment specifications. FHA funds enables you to get a house putting off because the nothing since the 3.5% of the purchase price of the property during the closing.

Towards an excellent $two hundred,000 family, step three.5% will be $seven,000, unlike a conventional mortgage while very much like 20%, or $forty,000 in this situation, might possibly be needed to get the loan. FHA money also provide somewhat more relaxed credit score limitations, so these include accessible to significantly more consumers.

One disadvantage to an FHA mortgage ‘s the need to pay a funding percentage. With the a traditional mortgage, you will need to pay for private home loan insurance (PMI) for those who provide less than 20% as a result of closure. PMI is an additional fee every month to purchase difference in the deposit, and this will improve month-to-month home commission. For people who render below 20% down after you purchase a property which have a traditional mortgage, you could potentially clean out their PMI once you at some point come to 20% security. Yet not, FHA loans never treat its financial support payment, which contributes an additional fees to personal loans for bad credit Indiana your mortgage repayment each month.

While this may seem like a major disadvantage, an FHA loan should be refinanced so you’re able to a normal loan when you can 20% equity, hence eliminates the funding fee while also assisting you end PMI charges. Refinance financing offer even more flexibility for homebuyers.

USDA Loans

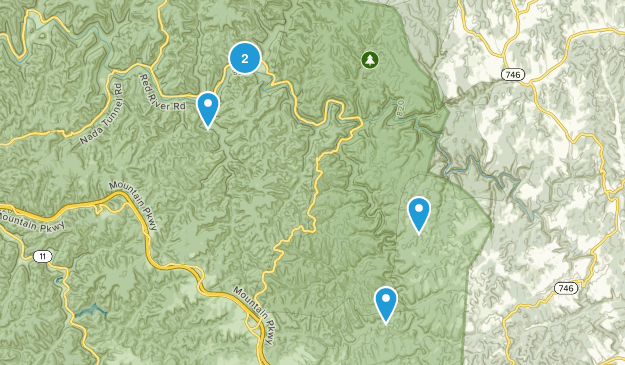

With regards to property pick from inside the an outlying or suburban urban area, good USDA financing might be the best fit for a single father or mother. Whenever you are USDA loans are only found in certain organizations rather than all the customers often meet the requirements, he’s one of the simply alternatives you to definitely solitary moms and dads has actually to order a home with out several thousand dollars inside an excellent advance payment.

The brand new You.S. Company regarding Agriculture’s Solitary Friends Homes Secured Financing System (USDA Financing system) was made to assist remind monetary development in quicker densely inhabited areas. You really must be to buy a property in a sufficiently rural or suburban city so you’re able to be considered. Should your home qualifies, you can purchase property with $0 off.

To help you be considered, property need to be into the USDA’s outlined eligible city, and the consumer should not exceed a certain earnings count. You should also agree to directly undertake the house as your first quarters (you simply can’t make use of this variety of loan to buy a financial investment property) and the house you buy need to be when you look at the secure, livable status. This may generate a good USDA loan a fantastic choice to have solitary moms and dads that have less money off selecting a secure where you can find relax inside that have a baby.