-

After you have examined your credit score, it’s time to decide how far collateral you’ve got in your household

After you have examined your credit score, it’s time to decide how far collateral you’ve got in your household It is a large cause for deciding the size of the loan. installment loan company Bakersfield CA To help you calculate your house security, deduct your home’s value regarding number you continue to are obligated to pay with the the financial.

Particularly, in case the house is well worth $500,000 and you nevertheless owe $175,000 with it, you have got $325,000 during the collateral. Remember that a lender commonly normally require you to remain fifteen% 20% of one’s residence’s really worth when you look at the security, so you will not be able to obtain an entire $3 hundred,000 with a house guarantee financing.

What if their lender requires one to keep 20% of your own residence’s worthy of into the security. Which means the most you are able to obtain try 80% of residence’s worthy of, with no number you still are obligated to pay on the first-mortgage.

To find the restrict amount you could potentially borrow, multiply your residence’s value ($five hundred,000) by the 80% (0.8) then deduct the total amount you still owe ($175,000). Using this picture, the absolute most you can obtain that have a house security loan is $225,000. You are able to see the picture less than:

3. Assess The DTI Proportion

Your debt-to-income (DTI) ratio was a percentage indicating how much cash of your own month-to-month earnings is used into the month-to-month personal debt repayments. This will be a key metric to possess lenders to decide your ability to settle that loan.

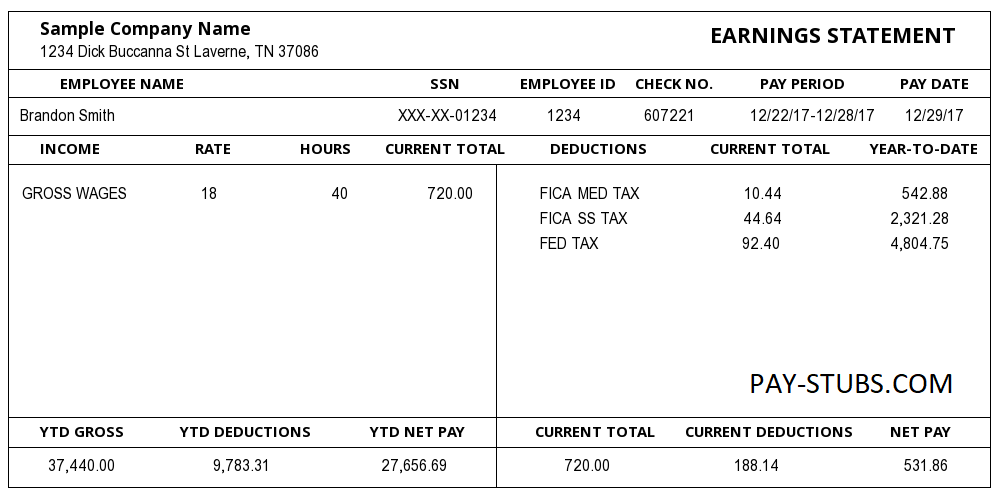

So you can determine your own DTI, start by adding up all of your current month-to-month personal debt payments. This can include costs for the book otherwise financial, handmade cards, auto loans, student education loans and any other monthly obligations money you have got. Second, divide one shape by the terrible month-to-month income. That is your earnings just before taxes or write-offs. Then separate your debt costs by your month-to-month revenues and you can multiply by 100. You to count will be your DTI ratio found as the a portion.

4. Look for People to Co-Sign

Finding an excellent co-signer is a great means to fix replace your odds of delivering a home collateral mortgage for those who have poor credit. Good co-signer are someone who agrees making repayments in your loan if you can’t. Good co-signer that have a good credit score decreases chance into the lender because they act as a back up when your number one debtor never make payments. However, so it arrangement is even a threat towards co-signer. If the primary debtor don’t take care of the loan, they should begin making the newest money and take a giant strike on their borrowing from the bank.

In the place of working to change your individual credit, an excellent co-signer can help your chances of qualifying having a house collateral loan instantaneously rather than finding the time to blow off debt, best mistakes on your own credit history and take most other measures in order to improve your credit history.

5. Produce A page Out of Reason

A letter regarding explanation try a file that explains some thing during the your credit report that might cause lenders so you’re able to refuse your a good house equity mortgage. It letter might be a valuable unit so you can clarify negative scratching in your credit report, such early in the day bankruptcies, foreclosure or overlooked costs. If you’re these marks alone may jeopardize your capability to help you qualify for a property security mortgage that have bad credit, a letter detailing those individuals affairs and exactly how you really have increased the financial situation since may go a considerable ways.

A letter of reason is also a powerful way to describe non-derogatory information on the credit report you to definitely a lender ple, when you have enough time gaps on your own a career background as you were looking after an infant, went back to college otherwise was self-working, you might explain the information in the a letter of reason.