-

FHA financing-mortgage loans covered of the FHA and you may granted by the an FHA-acknowledged lender-still exist now

FHA financing-mortgage loans covered of the FHA and you may granted by the an FHA-acknowledged lender-still exist now The root suggestion trailing the program try one to by providing insurance coverage in order to loan providers, more individuals would fundamentally qualify for mortgages-and purchase home. And it spent some time working. Immediately following mortgage lenders know government entities would make certain the funds, it permitted them to bring alot more good terms, like requiring simply 20% down and you will installment regards to 20 in order to 3 decades. This new FHA succeeded at stabilization after which revitalizing federal homes ericans having exactly who homeownership had immediately after been out of reach.

In place of a number of other The Price programs, lawmakers in the Arizona spotted a purpose to your FHA even with brand new worst results of the nice Anxiety had dissipated. In the 1965, this new FHA is incorporated into the newest freshly formed Service of Housing and you may Metropolitan Advancement (HUD).

Readily available for reasonable- to average-money consumers, needed a diminished minimum downpayment and lower fico scores than just of numerous antique mortgages. They are specifically popular with first-time homebuyers.

Criticisms of the National Homes Work

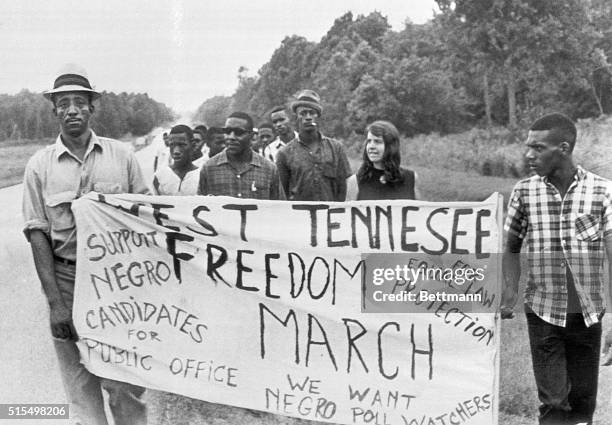

Since the production of the fresh FHA is a benefit to several Us americans, in addition put aside most of them-instance African People in america or other racial minorities.

On the 1930s, ’40s, and you can ’50s, the latest FHA concentrated the financial support insurance work into the fresh groups and you may suburbs are constructed on brand new corners of one’s country’s metropolitan areas, whilst declining so you can give to people hoping to get belongings in certain communities. Actually, the newest FHA manage specify certain specified areas as risky-generally on the basis of their racial role-and you can refuse its government http://www.availableloan.net/installment-loans-tx/san-antonio/ financial backing with the property in these parts. This step are also known as redlining since the officials and you may loan providers would literally draw a reddish range into the a chart in the neighborhoods where they will not invest, on account of class.

Black colored inner-town communities was those most likely as redlined. But people quarter anywhere close to a mostly African-American area often had redlined, too.

And people brand new subdivisions and you can improvements the FHA is thus wanting to subsidize? It commonly performed very having a necessity that not one of home be marketed to African Us citizens, or perhaps be ended up selling so you’re able to Whites simply.

Ramifications of FHA Redlining

Redlining practices was in fact sometimes rationalized for the grounds that the Black or fraction areas had been poorly handled thus, belongings inside have been bad expenditures. As for the this new suburbs, the new justification is when African People in the us bought home for the or close all of them, the home values of homes would decline, putting loans on the line-an assertion that had nothing empirical evidence about they.

This new Civil rights Work of 1964 together with Reasonable Houses Act, passed when you look at the 1968, assisted prevent this type of techniques-at least with regards to formal bodies policy. However, from the securing an incredible number of Us americans out-of homeownership getting years, they provided significantly into disparities and inequities inside money and you can wealth building among races that are available today.

Special Considerations

This new Federal Houses Act are the initial-although not the final-government effort to balance new housing industry while in the times of financial crisis. Check out authorities software you to definitely been successful they.

Property and you can Monetary Recuperation Operate (HERA)

New Housing and Economic Healing Act (HERA) try drafted to deal with the newest come out on subprime home loan drama out-of 200708. The brand new act greeting new FHA to ensure up to $3 hundred million when you look at the brand new 29-12 months fixed-rate mortgages to possess subprime consumers. They allowed states so you’re able to refinance subprime finance that have home loan revenue bonds and you may offered an effective refundable taxation credit getting accredited very first-big date homeowners.

HERA is in the course of time designed to replace personal believe regarding the troubled government-backed people (GSEs) you to definitely package home based money-particularly Federal national mortgage association and Freddie Mac computer. They created the Federal Property Money Institution (FHFA) to place those two major customers and you can backers of mortgage loans not as much as conservatorship.