-

Key Provides and Gurus brand new DHFL Lender Financial EMI Calculator

Key Provides and Gurus brand new DHFL Lender Financial EMI Calculator DHFL home loan calculator can help you estimate your month-to-month payments effortlessly. By entering your loan number, period, and you can rate of interest, the fresh DHFL home loan EMI calculator will bring a precise estimate, making sure most readily useful economic planning your residence mortgage.

It takes lots of partnership and research order your dream household. It is an emotional task that requires cautious thought and you can execution. Located in a secure environment with a strong structure was only one or two aspects of they. Before you apply for home financing, you must make sure your funds and mental really-getting are located in purchase.

Before applying to possess a home loan, you can influence the month-to-month instalments utilizing the DHFL mortgage EMI calculator. Planning your will set you back is important to steer free personal loans for bad credit in Arizona from any potential financial difficulties. They aids in choice-and make and have you organized about procedure.

Before you apply getting a property loan, make sure you are alert to everything to know in regards to the on line EMI calculator.

If you are intending to buy a different home with an effective DHFL mortgage, its necessary to bundle the expenditures to cease people trouble later toward. With this in mind, making use of the DHFL bank mortgage EMI calculator can be extremely of good use. Before applying, listed here are numerous justifications for using new DHFL financial mortgage EMI calculator.

- You could assess whether you are deciding on the most readily useful choice for your financial budget because of the evaluating your own EMI rates with other interest rates available with most other reputable Indian banking institutions.

- Additional loan quantity, rates of interest, and you may tenures are all alternatives you are able to look for. By using so it setting, you might rapidly decide which package is the best for you aside of all the available options.

- You should use the fresh calculator to help you determine the remaining mortgage course from inside the period, which will clear up the latest fees techniques to you personally.

- They uses the house financing EMI algorithm: p*r*(1+r)n/([1+r)n]-step 1 to ensure that you receive the real amount you are required to shell out. You can trust brand new EMI calculator out-of DHFL lenders partially because conclusions was right.

- Before carefully deciding, explore solution on the web EMI hand calculators away from various banking institutions if you were to think the new figures conveyed dont fulfill your financial allowance.

- Even after you approved the borrowed funds, you can nevertheless check out the authoritative page and use the internet EMI calculator to ensure your own position to discover exactly how much was nonetheless owed for the remainder of brand new loan’s term.

Secrets which affect Home loan EMI

- Accepted loan amount: Before you take away that loan, the entire amount borrowed will play a sizable area within the determining how much your EMI could well be. If loan amount is more additionally the financial tenure try faster, their monthly payment number grows immediately. Rates of interest on top of that rise in the event the amount borrowed is on the latest higher front.

- Interest rates: One of the key determinants regarding EMI cost is the focus price. The new EMI immediately increases pursuing the name whenever interest rates are nevertheless large. DHFL was able their interest during the 8.75% for all of its members. Evaluate the agreements before applying having property mortgage observe which one is the best for your.

- Tenure: The house mortgage tenure course you select before taking away a good home loan significantly affects the amount you are going to need to pay down fundamentally. Brand new payment expands with the amount of the newest book. You will have to shell out straight down monthly amounts once the name lengthens. Although not, extent payable along with increases once you prefer a longer tenure out of 20 so you can thirty years. For further all about casing mortgage prominent fees, head to this site.

Note: To be certain you are with the proper amount that suits your value, you could swap away such thinking whenever figuring their EMI playing with our home financing EMI calculator Asia DHFL.

How a keen EMI Amortisation plan helps with EMI cost?

An amortisation plan is actually a table you to exhibits the newest bifurcation out of all of the EMI fee in two bits dominant amount and you may focus count. Brand new amortisation plan can aid your into the focusing on how much payment of any EMI percentage is just about to the principal amount.

Utilising the amortisation plan calculator, you can keep track of your payments and people a fantastic attention. Additionally will let you change your meant mortgage cost plan. Which have an amortised loan, you could pay-off the loan more rapidly because of the enhancing the count because of the bank for each and every percentage. You might progressively improve your security by paying the new loan’s prominent and you can notice likewise by using an EMI amortised plan getting mortgages.

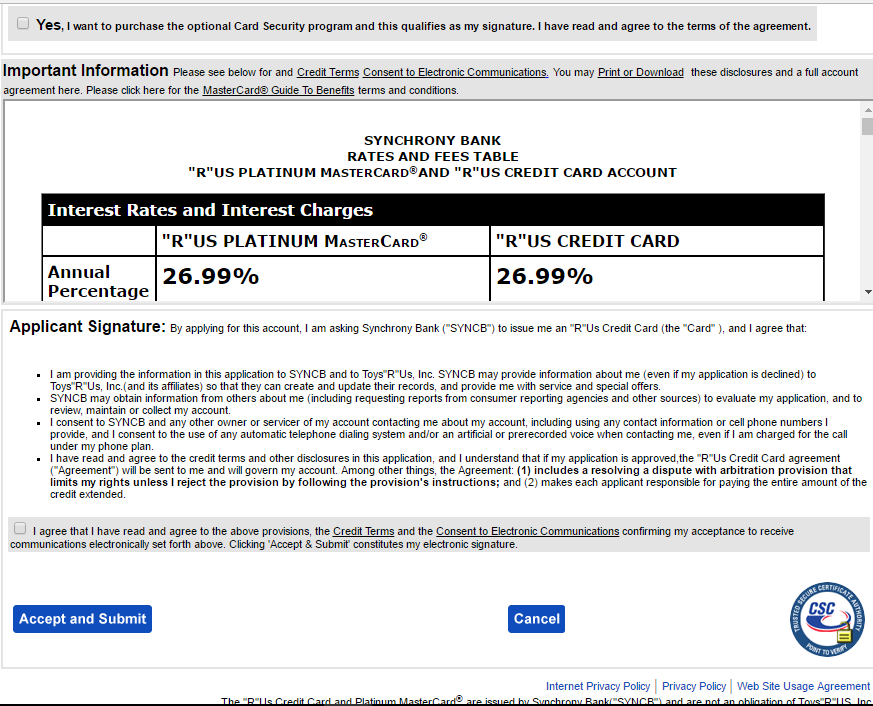

Review Off Mortgage Rates out of SBI, HDFC, ICICI, Kotak Mahindra & most other Finance companies

DHFL currently even offers the clients home loans that have interest levels starting at 8.75%. Less than ‘s the financial emi review of various finance companies:

DHFL Lender Housing Loan EMI Calculator for various Number

Mention : If you would like understand what ‘s the formula to calculate emi to own home loan, upcoming right here its: [P x R x (1+R)^N]/[(1+R)^N-1].

Just how can NoBroker Aid in availing Home loan?

NoBroker was a genuine property program which provides comprehensive home loan studies and properties. Due to their user-friendly construction and simple units, it’s also possible to quickly and easily estimate your house financing EMI. You can buy an exact imagine of monthly costs of the going into the platform’s loan amount, interest, and you may tenure.

At the same time, NoBroker can assist you from inside the contrasting several loan also offers out of various loan providers to generate an educated alternatives. You can be certain you’re getting the greatest rates for the your property loan through its qualified advice which help. In addition, NoBroker can help you save perseverance because of the assisting that have the mortgage software processes. With the 100 % free DHFL financial EMI calculator, you could begin on the road to finding your goal away from home ownership.