-

Get a home With just 3% Off? Yep, It will be possible

Get a home With just 3% Off? Yep, It will be possible Purchase a house In just step 3% Off? Yep, You’ll be able

For many years, the brand new Government Casing Management is actually new queen of your own reasonable-down-commission home loan slope. Now, Federal national mortgage association and Freddie Mac computer, the government-backed companies that provides investment into mortgage business, is design mortgage products to have hopeful homebuyers with thin offers accounts.

Having Fannie Mae’s HomeReady and you may Freddie Mac’s House You can easily, a beneficial step 3% advance payment — otherwise what loan providers refer to as 97% loan-to-worthy of — is obtainable toward therefore-named old-fashioned financing. Conventional financing will be mortgage factors most often granted by loan providers.

Federal national mortgage association HomeReady

Jonathan Lawless, vice president to own product creativity and you will reasonable housing during the Federal national mortgage association, says the current reasonable-down-payment FHA loans might be “high priced,” with initial and continuing mortgage insurance fees you to last for the newest lifetime of the mortgage. So Fannie mae decided to build an aggressive lowest-down-percentage loan product of its very own.

Discover earnings constraints covered on HomeReady system, but from inside the appointed lowest-earnings neighborhoods. Fannie’s standard 97 LTV mortgage has no such as for example constraints, if at least one borrower are a first-go out domestic visitors.

Although the FHA is recognized for their relaxed lending conditions — as well as a credit score at least 580 — Fannie’s HomeReady keeps a tiny push space of its individual. Permits moms and dads become co-borrowers — in place of residing in your house — and you will repayments regarding a rental assets is regarded as as the an enthusiastic income source. Individuals also can possess around a fifty% debt-to-money ratio and you may a FICO score only 620.

But simply cleaning the fresh new DTI and credit score hurdles will not obtain your acceptance. Lawless says Fannie mae appears to avoid “exposure layering” — numerous products that work against the borrower’s creditworthiness. A low credit history was one to. Incorporate a premier DTI and you’ve got a couple influences facing your.

“It would never be possible accomplish good [97 LTV loan] that have good 620 FICO and you may a fifty [DTI],” Lawless says to NerdWallet. “You will you need compensating products.”

Freddie Mac computer Household You’ll

Freddie Mac computer has its own 97 LTV system, Family Possible. The application form assists lowest- so you’re able to moderate-income consumers which have money created for particular lower-earnings elements. Repeat customers may meet the requirements.

If you’re Home You’ll will continue to be Freddie Mac’s “flagship” sensible financial device, Patricia Harmon, senior unit manager during the Freddie Mac computer, says there can be alot more autonomy within the an alternative system called HomeOne.

At least one borrower need to be a primary-time home customer, however, there are no income constraints or geographical limitations. And you can Harmon echoes Lawless’ alerting from underwriting guidelines.

“If the a debtor keeps a beneficial 640 credit rating, that’s not an automatic recognition, nor is it an automatic refuse. It might rely on lots of most other characteristics one to borrower have,” Harmon claims. “The better the financing rating, the reduced your debt, the greater amount of cash reserves in place — the higher the possibilities of being approved.”

Solutions when step 3% off try a problem

“No matter if 3% musical small, because home prices was rising, it is become a bigger and you can big matter and you will harder and harder to save for,” Lawless says.

Federal national mortgage association and you can Freddie Mac are attempting to processor chip out in the you to definitely hindrance as well, allowing crowdsourced down payments, considering Airbnb earnings and also lease-to-individual apps.

Crowdsourcing

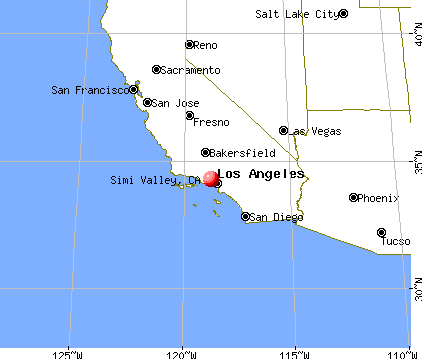

CMG Economic, a loan provider situated in San Ramon, California, has created Homefundme, where potential home buyers normally tap new cumulative pockets of its social network.

“They’re able to basically query their family, members of the family, lovers, associates, Twitter friends to give all of them four cash here and there” towards a down payment, Lawless states.

Local rental money

At the same time, Seattle-oriented Loftium lets prospective homebuyers to book a space inside their upcoming where you can find assist seed the deposit.

In exchange for the next display of one’s lease out of your area toward Airbnb, Loftium usually forecast the money and provide you with a portion regarding one to initial, which you can up coming affect your own down payment.

The latest borrower will have to activate step one% of complete advance payment; Fannie mae lets additional 2% in the future out-of Loftium, Lawless says.

Lease-to-own

“You begin because the a tenant, however also have the chance to pick [our home] within a predetermined price throughout the many years later,” Lawless says.

Not all lender participates throughout these pilot programs, despite brand new endorsement away from Fannie or Freddie. Because of the conversing with a number of loan providers, you can aquire a notion once they ensure it is this type of the fresh new off-payment-strengthening try software.

A lot more eligible features could help

Use of financial funding, despite low down costs, however does not solve the trouble regarding insufficient available homes. Old-fashioned resource is even looking to assist target this problem.

Fixer-higher money covered towards a property get https://cashadvancecompass.com/payday-loans-or/ home loan — in addition to having 3% down money — is one to respond to. Lawless says Fannie’s lso are could have been “clunky” in past times, however, has been recently current and you may altered becoming easier to use.

Is actually traditional 97 LTV finance a lot better than FHA?

FHA-supported loans remain attracting the fresh lion’s share regarding very first-time homebuyers, but really 2017 financial quantity was down 4% versus 2016. At the same time, the amount of conventional funds to own earliest-timers is right up 18% for the same several months, with respect to the Genworth Home loan Insurance policies First-Date Homebuyer Report.

Do Michael Fratantoni, captain economist with the Mortgage Lenders Relationship, faith these types of step 3% down old-fashioned mortgage programs are experiencing a critical difference to the the original-time household client markets?

“Sure, specifically for lenders just who continue to be careful away from Untrue Says Operate exposure, old-fashioned 97 financing is gaining grip,” Fratantoni says to NerdWallet. New False Says Work brought about a ton off lawsuits by You.S. Department of Justice up against loan providers accused out of con from the underwriting regarding FHA fund included in the construction crash 10 years back.

“Although not, such money will always be more pricey than FHA fund to possess borrowers which have less-than-prime borrowing,” Fratantoni claims. “All-into the costs — mortgage repayment and you will financial insurance rates — is quicker to possess FHA fund than simply antique financing if a beneficial borrower’s credit rating is approximately 700 otherwise down.”

Explore your own lower-down-fee financing choice, FHA and you can traditional, that have about three or even more loan providers, evaluate charges and home loan insurance premiums, to discover what works ideal for your situation.