-

GreenSky’s underwriting is dependant on a similar income, Credit ratings and you will borrowing agency accounts you to definitely banking institutions purchased having decades

GreenSky’s underwriting is dependant on a similar income, Credit ratings and you will borrowing agency accounts you to definitely banking institutions purchased having decades A lot of his 800 team are employed in his Wonkaville as well as a keen outpost within the Kentucky, entering old-university things like financing upkeep and you will company recruiting. Specific fintech lenders play with tens and thousands of study situations, of later years deals and you can college values to help you social networking interactions, to gauge the latest riskiness out of carry out-feel individuals (come across container, below). Our company is early-designed. There’s nothing exotic, Zalik claims. It should be safe and predictable for the bank people. Tim Spence, the principle strategy manager at the Fifth 3rd, concurs: We spotted eyes so you’re able to attention having GreenSky since it regarding the type of the debtor. A unique brighten: GreenSky offers the bank the new relationship which have trendy users to help you which it can pitch almost every other items.

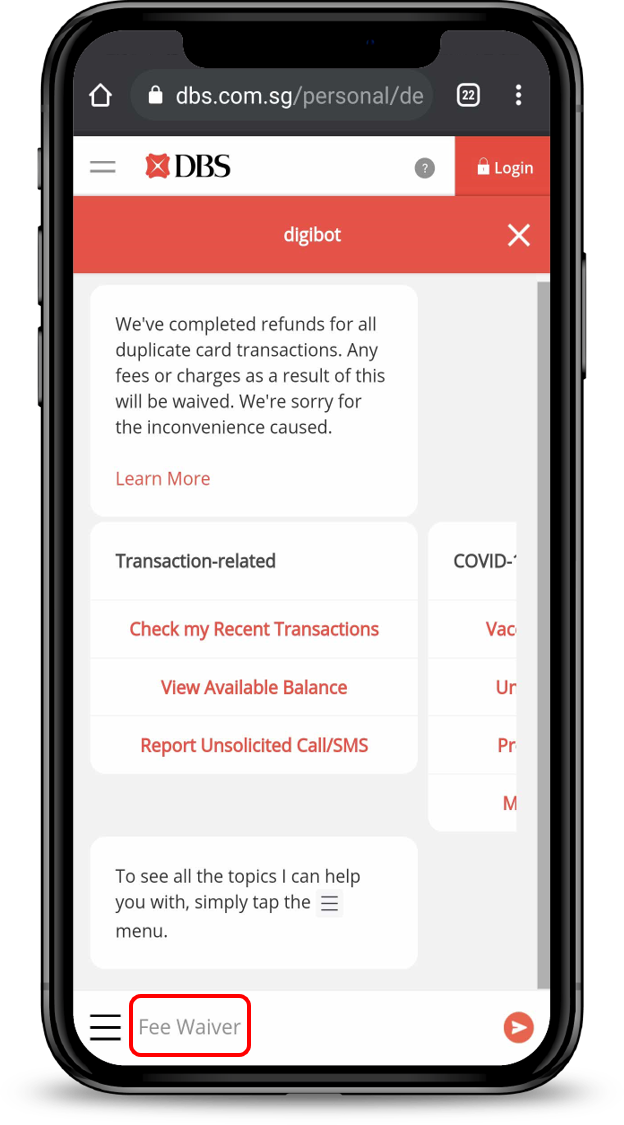

In the event your requirements are pretty straight forward, the new delivery would-be more so. GreenSky’s imaginative model depends on sales agents on to the ground who recreation device straps and Timberlands, maybe not MBAs. Ergo, Zalik’s pleasure and you may pleasure, this new GreenSky cellular app, makes use of exactly what the founder calls the newest weight thumb laws-all of the setting can be done toward a smart device otherwise pill having fun with you loans in Stewartville to definitely large little finger.

Nevertheless they claim within the a national lawsuit that they was basically astonished understand-following the builder had currently stolen the income-if they don’t pay the mortgage within this those individuals 18 days, they will owe back notice out-of day you to

A builder or their salesperson is seated in the a prospective user’s table discussing the new screen otherwise a swimming pool. To help you close the deal-or convince a customer he is able to manage specific add-ons-the guy even offers financing. He scans the consumer’s driver’s permit with the software, next serves up their equipment and you can asks him/her to help you get into merely about three circumstances: Income, social protection number and phone number. Certain 95 % off possible borrowers rating a choice towards the room. Recognized loans rise in order to $65,000, into the perfect terms determined by the fresh borrower’s borrowing from the bank, your options the new company elects to provide and you can subsidise, in addition to possibilities the user picks.

But GreenSky still faces the sort of legal worries that are unavoidable if the individual that pitches the mortgage in addition to receives the proceeds

The latest builder is also in charge of working out a repayment plan that have clients. This new GreenSky mortgage money is taken to the latest company particularly a typical credit card fee, through LearnCard rails, and company normally tap money-toward borrower’s consent-to own a deposit, getting also have commands otherwise when individuals conclusion goals are satisfied.

The greatest entice getting consumers: Zero-notice resource to own a promotional ages of 6 to 24 months. A lot of GreenSky’s borrowers dont pay a penny when you look at the focus as they repay the bill through that span. However, if they will not, these are typically to the link to the deferred appeal, from the rates anywhere between 17 per cent to help you 23 percent. Home owners exactly who proper care they cannot pay back the mortgage from the promotional months can also be decide as an alternative having a lowered fixed price-typically 5 per cent to help you 7 per cent. Consumers plus always spend an effective $39 setup percentage, hence goes to financial institutions.

Zalik’s builder model allows GreenSky to cease some of the profit costs you to load almost every other on the web loan providers, eg direct-mail. And its particular lender financing has greet it to quit one fall out regarding Credit Club’s entry a year ago this marketed loans in order to an investor you to don’t fulfill the consumer’s criteria.

Such, when Todd and you may Sylvia Alfortish accessible to place solar power panels toward the latest roof of their Louisiana household during the 2015, people say these people were informed it might all the way down its monthly electric expense and there could well be no attract on the $ten,000 loan towards earliest 18 months. (The fresh court supplied GreenSky’s request in order to kick the fact in order to arbitration, as its loan arrangements wanted. GreenSky, if you find yourself declining to help you discuss personal instances, states all of the customers receive its loan files in the us mail and will and discovered them on the web.)