-

Contrary mortgages permit individuals to help you open their gathered house security, converting it towards the available dollars

Contrary mortgages permit individuals to help you open their gathered house security, converting it towards the available dollars Will you be an older homeowner surviving in Washington, otherwise gonna retire regarding the Huge Canyon County, and seeking a method to complement retirement earnings?

With broadening living expenses and ineffective adjustments to Public Defense pros, you are most likely feeling discouraged. Luckily, really senior People in the us are property owners, causing them to uniquely qualified to availableness cash making use of the extremely put where it put their lead a night – their property.

That it Washington contrary mortgage book provides a comprehensive article on it unique monetary product being generate the best decision regarding whether a reverse financial ‘s the right choice for you.

Knowledge Reverse Mortgage loans

Domestic Guarantee Transformation Mortgage loans (HECMs), often called contrary mortgages, was borrowing products specifically made to have people who’re 62 age dated otherwise elderly.

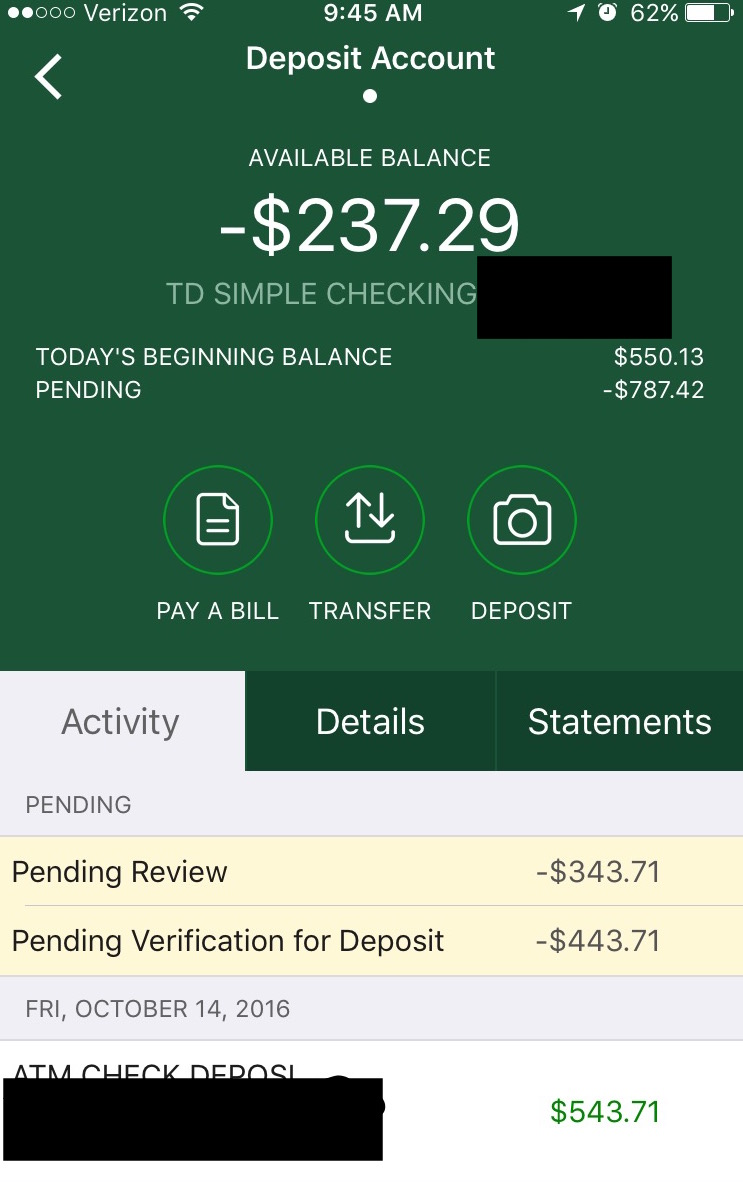

In the place of conventional domestic equity funds otherwise credit lines (HELOCs) instant same day payday loans online Washington which need monthly installments will ultimately, opposite mortgages jobs in a different way.

For folks who continue to have a conventional financial on your own household, first thing an other financial will perform was accept you to mortgage. The remainder contrary home loan continues are paid centered on the brand new homeowner’s preference: lump-share, normal monthly payments, personal line of credit, otherwise a mix of these.

No monthly installments must pay-off an other home loan. But not, residents are obligated to pay possessions taxes, homeowners’ insurance policies, and maintain the house.

Payment out of a face-to-face mortgage is just caused in the event that people want to forever move around in, offer our house, otherwise through to this new passing of the very last thriving citizen.

Contrary mortgage loans are finance which might be controlled of the You.S. Agency out-of Houses and Urban Development (HUD), into backing of one’s Government Construction Management (FHA).

Washington Reverse Home loan Qualification Criteria

To become eligible for an other mortgage when you look at the Washington, home owners need certainly to fulfill specific specific requirements, like the following the:

- Many years. At least one resident must be no less than 62 yrs . old.

- Home. The house must be the homeowner’s number one residence.

- Security. It is recommended that residents features a considerable amount of collateral within their assets.

- Status of the house. The house can be better-managed.

- Obligations. Home owners have to have the latest way to safety this new constant property fees, homeowners’ insurance coverage, HOA fees (if the appropriate), therefore the right repairs of their family.

- Qualified possessions. The house might be entitled to a reverse mortgage. Qualified services were unmarried-family members house, 2-4 equipment features towards homeowner occupying one to tool, FHA-acknowledged condominiums, or accepted are available residential property.

- Counseling. Before you apply to possess an opposing home loan, individuals need to match the prerequisite out-of in the process of an intensive counseling example that have a third-party counseling provider passed by HUD.

Just how an opposing Financial May help

Enhance Advancing years Money. A contrary financial also have an established and you can consistent supply of money. Which monetary choice facilitate inside layer some costs, as well as go out-to-date lifestyle can cost you, unforeseen medical expense, or other unforeseen financial obligations.

Zero Monthly Mortgage payments. That have a reverse financial, property owners aren’t compelled to create month-to-month home loan repayments. not, he could be guilty of assets fees, insurance rates, and you will family restoration can cost you.

Age positioned. A contrary home loan allows the elderly to stay in their homes since it decades, that’s very theraputic for whoever has started long-name owners and wish to will still be next to nearest and dearest.

Flexible Percentage Choices. You can find numerous disbursement options available that have contrary mortgage loans, delivering independency for borrowers to receive money. Discover multiple options available for researching the money. There is the choice of choosing they in one swelling share, given that a personal line of credit, in monthly payments, or a combination of these procedures.