-

Do FHA Money Have the same Interest levels to possess Standard Home?

Do FHA Money Have the same Interest levels to possess Standard Home? - Debt-to-earnings proportion: In the event the lender are choosing the standard domestic interest, it is something when you have a student loan you’re nonetheless trying to pay. It’s a very major problem for those who have a student loan, $step one,000 inside credit card debt, scientific loans, and you will an installment to your an excellent Corvette you purchased half dozen years back. Even although you generate more than $100,000 annually-more your situation works out the second situation, the more unlikely you are to acquire a low interest rate on your standard home loan.

- Mortgage insurance, collateral, and you can down costs: Any of these tends to make a distinction about rate of interest you can get if you find yourself to shop for a standard house. Particularly, if you possess the loans and also make i need money desperately today a down-payment worth 25% of one’s residence’s well worth, loan providers will give you a reduced interest rate. A similar legislation implement for folks who persuade them that you will be eligible to financing otherwise home loan insurance rates or if you give you the family as the security.

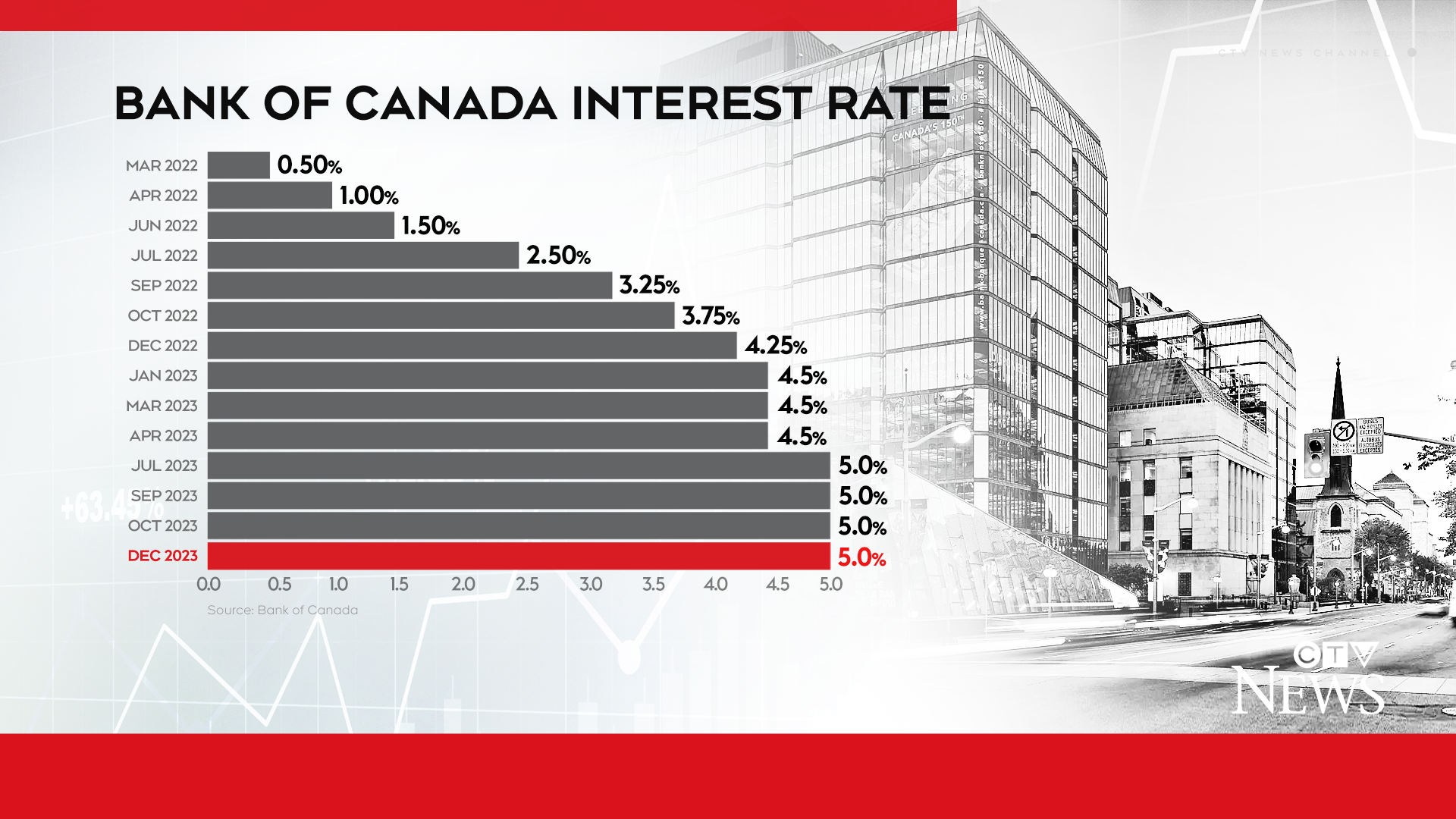

Record could go towards the and on, and it seem to may include issues that is actually beyond your borrower’s control-such as the Federal Reserve’s rates, and that feeling men in the usa in a number of form-otherwise the liquid assets and you will loans, to see if you could potentially afford to find the domestic outright.

These types of government-recognized mortgage loans are available for standard homes and so are an glamorous solution that is built to lower the barrier out of entry having home owners. FHA finance to own standard homes provides straight down requirements with the down payments, fool around with repaired rates of interest by-design, and generally need straight down lowest credit scores than just individual antique fund.

They also have another set of standards as they are provided with the us government. Particularly, FHA checks and you can appraisals are far more strict than traditional loans-all inch of the house need to be during the sufficient doing work standing, there can not be people head-created decorate on wall space or ceilings.

you will be required to pay for home loan insurance rates, once the FHA money can handle all the way down incomes and you will fico scores.

The good news is, most modern standard belongings are designed to meet up with FHA minimum possessions criteria. Yet not, FHA money are apt to have standard if not highest interest levels compared to the specific unsecured loans.

Modular Domestic Rates on Va Financing

To own homebuyers in addition to their spouses which offered in virtually any part of your own You.S. armed forces, discover opportunities to be eligible for financing having a lower interest rate than simply antique choices. If you find yourself Pros Activities (VA) mortgage brokers feature requirements with the type of domestic getting purchased-really mobile and lots of were created homes could well be declined-modular residential property are usually acknowledged for those special regulators funds.

For example FHA finance, Virtual assistant financing incorporate a special set of eligibility requirements , both for the house as well as for veterans otherwise latest services users:

- Given that lead debtor, your otherwise your lady need meet up with the minimal effective-obligation solution requirements. The full time necessary can differ based on when you served, whether you’re a police officer, together with branch for which you offered, but typically needs at least 3 months off consecutive service.

- To be qualified, you need to supply acquired a keen honorable discharge or even the equivalent thereof.

- Your house we should buy need certainly to read a beneficial Va appraisal and check to guarantee the property match the department’s conditions. Note that such requirements is distinct from those individuals you’ll need for an enthusiastic FHA loan.

Borrowing from the bank unions one serve armed forces members, veterans, and their household, possess detailed facts and you may options on criteria to determine if you otherwise your wife be eligible for a Va-recognized mortgage

There are many more measures for taking whenever obtaining a loan on Va, specifically if you fall under certain organizations or teams.