-

Just how much Is actually Closing costs into the a refinance mortgage?

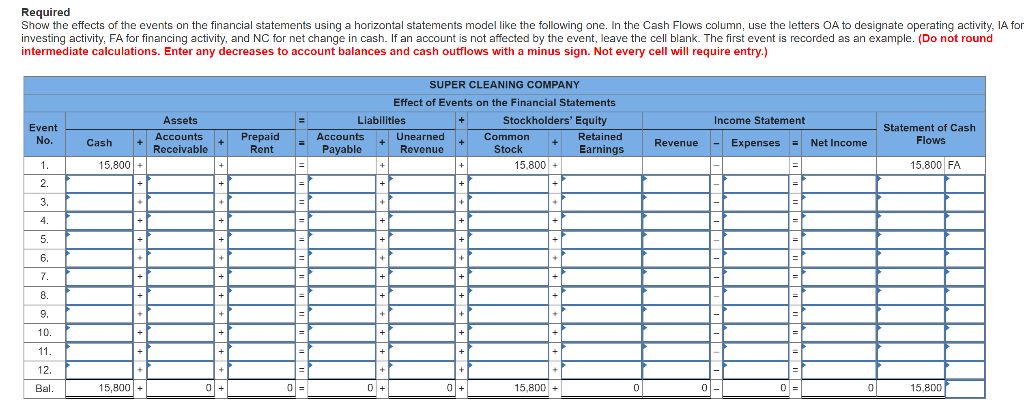

Just how much Is actually Closing costs into the a refinance mortgage? Refinancing your current financial is also get rid of your own payment per month and focus rates. However with all of the this new mortgage become closing costs. Would it be always beneficial? Let us look at the number on the individuals refinance circumstances to discover. Lets see if the price to help you refinance a mortgage loan continues to escalation in 2024.

Do you know the Average Home loan Refinance Closing costs?

Should you want to re-finance your loan towards a thirty 12 months notice, it means you need to select a drop around $90 monthly on your own fee to really make it worth it.

Toward up side, extremely loan providers enables you to move their refinance settlement costs toward your new financing. And that means you shouldn’t have to shell out cash beforehand.

Once you re-finance, you’ll encounter closing costs just like people who have your brand new financial loan. This type of include expenditures such appraisal charges, recording will set you back, origination charge, name insurance, and more. Due to the fact refinance closing costs may differ a lot more, Freddie Mac quotes the typical refinance to help you rates doing $5,000.

Specific mortgage financing enterprises can get advertise zero closing cost refinances, nevertheless these basically incorporate the settlement costs in the loan harmony or toward a top interest. That is why, their mortgage balance develops, resulting in high a lot of time-label attract expenditures.

In advance of proceeding which have one paperwork, its important to run thorough lookup to verify the pros and you will actual monthly savings. The fresh RefiGuide has the benefit of an internet site so you’re able to search for an informed agents and you will lenders offering zero closing cost mortgage loans along with your background.

Must you Shell out Closing costs When Refinancing mortgage?

That have a zero-closing-prices refinance, you have a few options: accepting increased rate of interest or an increased mortgage harmony. Not all lenders offer both differences of zero-closing-prices refinancing, so ensure that your financial provides the alternative you prefer. The cost to help you re-finance a speeds and you may title financial is generally different than a cash-out re-finance purchase.

Really in some indicates, it is. The thing is, you are going to constantly end expenses someplace to help you re-finance a mortgage.

If you have to pay beforehand otherwise within the loan, you will be investing some thing settlement costs, origination costs or a top home loan price.

A free home mortgage refinance loan usually has mortgage loan that is a bit large and come up with right up towards closing costs the lending company taken care of you.

The rate would-be .5% high along the lifetime of the mortgage, that may cost you tens and thousands of bucks a great deal more no checking account payday loans Napaskiak AK within the focus.

- Not lender charge

- Your own home loan harmony does not increase

- You pay absolutely nothing beforehand

- Might shell out increased interest

- The expense of the loan was considerably more expensive along side many years

- Don’t assume all bank offers a no closing costs option

Must you Shell out Closing costs Beforehand from inside the a great Mortgage Re-finance?

If you would rather not come out of pouch to blow for mortgage closing costs and you will lending charges, thought a zero-closing-costs home mortgage refinance loan. Even with their name, which house refinance isn’t totally with no settlement costs; you just will never be needed to outlay cash upfront. Rather, the lending company can get boost your interest rate or include the closure can cost you regarding the the new financing.

Preciselywhat are Closing costs on a great Refinance Today?

Refinance closing costs cover each other lender fees and you can 3rd-class charges sustained when you look at the financial procedure. When refinancing, youre obligated to pay this type of can cost you, mirroring the procedure of your own very first home loan.

It’s important to recognize that closing costs are not a predetermined amount; the magnitude try contingent into activities such as your geographical venue, amount borrowed, chose financial, certain loan program, and you will regardless if you are wearing down house guarantee along the way.