-

Could you Score home financing For many whore Unemployed?

Could you Score home financing For many whore Unemployed? Going of renting to purchasing was a high consideration for almost all People in america. Most of us have already been terican dream. However if you may be ranging from efforts, are homeownership unrealistic? Let us look closer on matter-of whether you can acquire property when you find yourself out of work. If you have questions regarding the information on your financial situation, envision asking an economic mentor.

Might you Score a mortgage If you find yourself Underemployed?

The easy cure for this real question is most likely no, since the most of the lender will need you to definitely possess verifiable income. That have money in the way of being an effective W-2 personnel is the proper way in order to qualify for home financing. Of many lenders wouldn’t consider financing to you if you are not able to bring verifiable earnings like that.

However, it will be possible to get a mortgage when you look at the a even more unconventional way. Some lenders commonly imagine most other earnings if it is significant enough to security the newest monthly payments from what you will be borrowing from the bank. Usually, as much as possible demonstrate that you possess earnings besides a beneficial W2-paying occupations then you will need to reveal an everyday amount of income from previous taxation filings.

Improve your Debtor Character

One which just do anything more you need to replace your full borrower reputation. Searching for a home loan is actually a procedure that concerns jumping compliment of particular hoops. Some of those hoops are while making oneself attractive to mortgage brokers. Fundamentally, aspiring homebuyers need several factors in place: a leading credit rating, a decreased personal debt-to-income proportion and you will adequate money to arrive to cover month-to-month mortgage repayments.

If you are already underemployed, it could be difficult yet not impossible and make their circumstances to mortgage lenders. Although not, out of work people that nevertheless are interested a property has options. To begin with, you can be underemployed and have a high credit score and you will a decreased loans-to-income proportion. The reduced the debt, new less cash you want arriving to stay at otherwise below the 36% debt-to-money proportion that it is suggested.

Establish Alternative Income Present

People have enough money to pay for a mortgage although they do not have a job. In the event your capital money will give you enough to build month-to-month mortgage repayments and you can purchase earliest bills also, you may not has actually far dilemmas persuading a lending company so you’re able to help you be a homebuyer.

The same goes for any other sources of income you might has actually, if or not of case payment, Social Safety, alimony, a life insurance policy, a present, or a genetics. When you yourself have a low-paycheck source of income that one may rely on as a resident, lenders is going to be ready to help, so long as your credit score and you may personal debt-to-earnings ratio was right.

Make your Companion The lead Debtor

Another option is to try to rely on the funds of someone else. Whenever you are purchasing property that have a partner that is operating features good credit and you can a decreased personal debt-to-earnings proportion, it may be ideal for your partner to take top honors to the financial software. In that way, your own unemployment won’t matter against you. Which is, but not, for as long as the partner’s earnings try sufficient to fulfill lenders’ standards.

Likewise, when you have moms and dads or other rich relatives that are ready so you can into home buying process, you can discuss a gift that will enable you to meet financial standards while you are ranging from jobs. A present likely may not be adequate to ensure you get your loan thanks to underwriting itself. But not, it may assist for folks who only have to features a particular sum of money throughout the bank to meet the requirements or if you you prefer more substantial down-payment.

Explore an excellent Co-Signer

Another chance should be to keeps somebody who has tall money and you may a powerful borrowing from the bank character co-indication the borrowed funds. You could attract a pops or relative having ready to give you a hand when you are in the middle efforts. This can fundamentally let them help you make sure the financing. This is certainly a hard market to your own nearest and dearest nonetheless it try possible. You might refinance after and take him or her off of the loan if you are back on your ft.

Realization

We choose to wait until they do not have a career ahead of prequalifying getting home financing. not, for others, prepared isnt an alternative. In the event the renting is more pricey than just to find towards you, or there are many more persuasive reasons why you should purchase a property while you are you have got zero business, you are not facing a hopeless task. Providing you or somebody who was prepared to make it easier to can be establish lenders with a high credit history, the lowest obligations-to-money proportion, and you may a substantial income source, persuading a mortgage lender to help you shouldn’t be also difficult.

Approaches for Buying a house

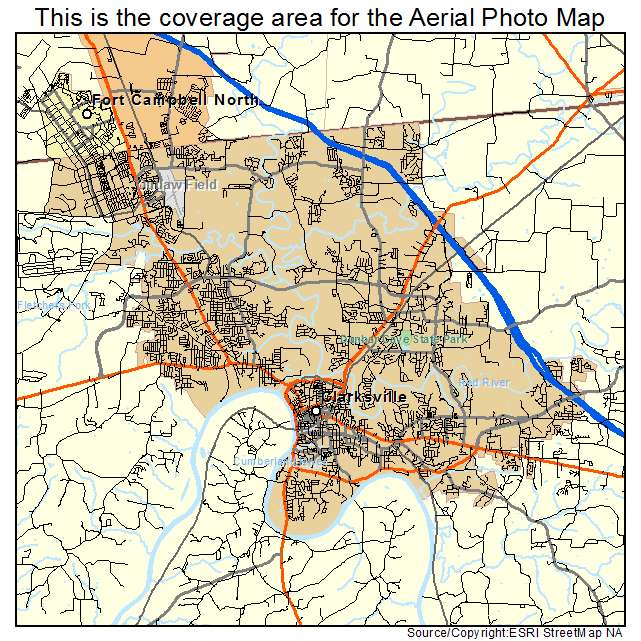

- To shop for a house may foundation into the big financial bundle, and that means you can i get a loan based on my tax refund may prefer to consult a monetary coach. Wanting an experienced economic advisor doesn’t have to be tough. SmartAsset’s 100 % free tool suits your which have as much as three economic advisers exactly who serve your area, and you can interview their mentor matches for free to choose which you’re effectively for you. While you are happy to come across a mentor that will help you reach finally your monetary requires, get started today .

- Work out how far domestic you can afford. Thereupon amount in mind, carry out a month-to-month funds and begin saving to suit your down-payment and you can closing costs.