-

8282 W Cactus Rd, Room E146, Peoria, AZ, 85381

8282 W Cactus Rd, Room E146, Peoria, AZ, 85381 Just how to speak about financing situations because of the altering the home Worthy of?

Change towards Value of you can expect to change the leads to a great extreme way. Lendersa sliders allows you to make punctual change to explore the financing alternatives.

- Enter the Amount borrowed yourself when you look at the Amount borrowed box.

- Go into the Cost by hand in Worth of field.

You might change the property value by the swinging the house or property Worthy of slider upwards otherwise down or by entering a different sort of Value of manually on Property value container.

Once you alter the Worth of, only the LTV vary, and Loan amount will remain an identical Amount borrowed.

Just how to talk about mortgage problems of the changing the borrowed funds Matter?

Transform on amount borrowed, in spite of this some, you will definitely change the results in a serious means. Lendersa sliders enables you to build quick change to explore your own capital possibilities.

- Enter the Loan amount by hand for the Loan amount field.

- Enter the Cost yourself into the Worth of field.

- There have been two ways to alter the Amount borrowed for the sliders:

Change the Amount borrowed of the moving the borrowed funds Amount slider. (Brand new LTV will be different, while the Property value will stay intact).

How exactly to mention mortgage situations from the switching the fresh new LTV Slider?

LTV is the acronym regarding Financing To help you Worthy of, and is the latest proportion involving the Amount borrowed and the Worth of. The fresh algorithm to estimate LTV was Loan amount split up by the value of.

Alter with the LTV, even so a bit, you can expect to change the leads to a significant ways. Lendersa sliders will let you generate quick alter to explore your own funding possibilities.

- Go into the Loan amount manually within the Amount borrowed field.

- Go into the Purchase price yourself during the Worth of field.

- You will find 3 ways adjust the fresh LTV:

Alter the Amount borrowed by the moving the borrowed funds Number slider. (The LTV vary, while the Property value will continue to be undamaged).

Lendersa Advanced Calculator

The new Trial calculator together with Difficult Money Calculator make you a standard guess with payday payday loan cash advance loan New York the version of fund you can expect in order to get. The next thing upwards is actually Lendersa Cutting-edge Calculator, the greatest credit calculator and a quantum lip over all other financial calculator around.

Lendersa Complex Calculator is far more varied and effective compared to Tough Money Calculator, while the Demonstration Calculator. It includes most of the analysis sphere needed seriously to determine your qualification for any mortgage.If you’re not yes on what loan you should buy, after that explore Lendersa State-of-the-art Calculator instead of the Difficult Money Calculator. Begin by going into the type of possessions along with your postcode and then click the Talk about The options key.

- Old-fashioned?

The advance calculator allows you to fool around with Lendersa LoanImprove motor to maximise your loan demand therefore a whole lot more loan providers would want in order to vie towards the advantage od planning your loan.

Regarding LoanScore

LoanScore (Mortgage Chance of Success Get) tips the chance to obtain using loan providers who possess coordinating mortgage applications on the borrower financing request. A borrower normally speak about of several questions and you may found multiple results for for each inquiry with unique LoanScore for every single effect. The brand new LoanScore imply towards debtor the number as well as the quality of the fresh lenders that happen to be shopping for considering their loan request. The fresh LoanScore score may include 0 to help you 99. A leading LoanScore (E.g., a lot more than 80) means of several desperate loan providers who’re trying to find organizing the loan according to the borrower consult. A minimal LoanScore ways zero otherwise not too many loan providers having a small number of coordinating programs. Lendersa financing optimization is a proprietary process the debtor can be deal with adjust the results off his mortgage request and you can increase LoanScore.

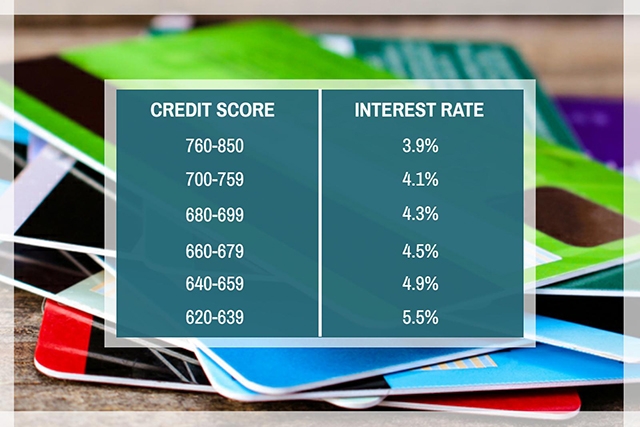

What’s the other anywhere between LoanScore and you may Fico rating? LoanScore and Fico Get are entirely additional score. FICO, otherwise Reasonable Isaac, fico scores was an approach to quantifying and contrasting your creditworthiness. Credit ratings range from 3 hundred to help you 850. Fico Rating measure your credit rating; its according to your credit score. LoanScore (Mortgage Chance of Achievement Rating) measures the chance you will located mortgage also offers out of loan providers dependent on your financing demand and your monetary certificates. The new LoanScore assortment was from 0 so you can 99. A Fico get typically helps improve the LoanScore, however it is only the main LoanScore. You’ll has perfect Fico get out-of 850 and you can LoanScore regarding 0; it indicates one to despite the expert borrowing from the bank, there aren’t any financing software which happen to be complimentary your borrower’s needs. And vice-versa, you’ll have a bad credit score regarding 350 Fico and you will LoanScore of 99, and this can be possible once you request financing centered on collateral simply as well as the lenders disregard the credit history. Per financing program has its book LoanScore. Every time you improve your mortgage consult, the apps changes, as well as the LoanScore of each system change quickly and you may automatically the latest Fico score stays a similar unless you yourself transform it.