-

5 what you need to know about refinancing to help you remodel

5 what you need to know about refinancing to help you remodel Refinancing is largely replacing your own old mortgage with a new you to definitely. This doesn’t mean your debt was erased (we wish!) but you can package the loan into the a much better contract to help you see your current requires. If you’ve already ordered a home and are usually repaying a financial, your upcoming large invest – instance a different automobile or a repair – offer an educated possible opportunity to review your money and make certain you get an informed offer.

Refinancing helps you benefit from the latest personal loans online North Dakota mortgage and you can borrowing from the bank facts, from down rates of interest to a great deal more customised have.

We spoke with the pros in the Newcastle Permanent Building People so you can acquire some straight-capturing, customer-concentrated advice about investment your own recovery.

step 1. Why should We re-finance before renovating?

Renovating does rates 10s or thousands of bucks, and thus you are able to probably have to chip into the established home loan or take out a different financing to afford costs. Refinancing now form you can aquire the money called for within a far greater rate.

It is a sensible way to obtain the additional financing you prefer to complete the renovations on a less expensive interest than simply say a personal loan, Newcastle Long lasting direct out of customer lending Greg Hooper claims.

Together with, consumers might possibly make the most of way more competitive prices than he is into with their newest standard bank. And additionally, [they may] make the most of cashback also offers which may use when refinancing.

2. What is actually working in refinancing?

Refinancing is not as tricky because you can think and can feel similar to people loan application – or potentially faster so.

Step one is to try to search and contact certain legitimate loan providers who will inform you your best means. Newcastle Long lasting are has just provided Greatest Bank in australia of the Forbes journal and that is a customer-owned shared lender, definition it generally does not means to fix investors. Having consumers at the forefront, they may be able reply to your concerns so you can determine what’s better for the personal earnings.

You will find timely recovery times regarding entry from application so you can effects away from basically 24 so you’re able to forty-eight regular business hours, Hooper claims. The complete techniques regarding application to payment should be normally between 2-3 weeks.

step 3. Can i blend all the my personal funds with you to definitely lender?

Not always, however, going for that lender for your home mortgage and you may financial is generally even more simple as it simplifies your finances and there are have a tendency to incentives to accomplish this.

For those who have all your financing having you to definitely organization, it creates it easier and simpler so you’re able to acquire extra loans making use of the equity on your own property, Hooper indicates.

By using the equity on the possessions to cover significant orders, eg vehicles, caravans, home improvements etc, may indicate a lower life expectancy price than just a personal loan.

Additionally, you will feel the one to credit director to help you with debt requires beneath the one rooftop, that will makes anything much simpler and easier having consumers.

cuatro. Preciselywhat are certain mortgage enjoys to look out for?

Whenever remodeling, you are able to probably require that loan product which allows you to availability financing easily and quickly to help you pay all the individuals builders, tradespeople, companies and the like.

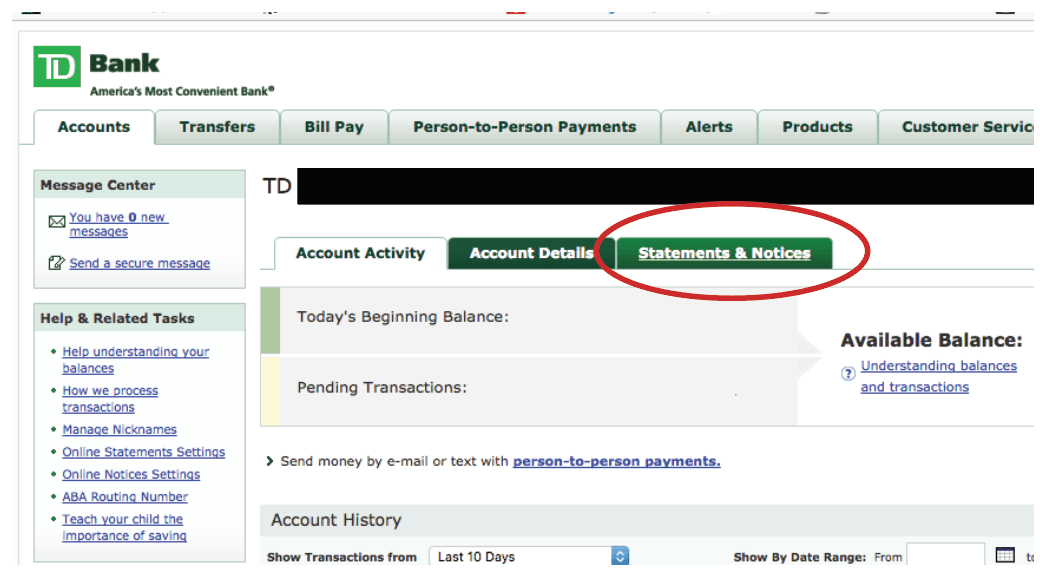

Offset and you can redraw facilities are perfect equipment provides when renovating, Hooper demonstrates to you. Thus giving the advantageous asset of spending less on the interest through the this time around. All these have might be related to your on line financial, so it’s an easy task to flow the cash doing ranging from account and you can to spend this new debts.

The guy adds that you will want to speak with the bank in advance of and you will following the recovery to determine hence possibilities are best for your needs and you can funds.

5. Do everyone have to refinance whenever remodeling?

Not at all. There are various streams when deciding to take and best one usually depend on your own personal money. There can be can cost you in it, including crack will cost you for those who have a predetermined price financial, that it would depend whenever you enjoy the future gurus on the action.

When refinancing which have purpose in order to remodel, it is critical to be mindful of the loan to worth proportion (LVR), Hooper claims.

Loan providers Mortgage Insurance policies (LMI) could possibly get use and is also good for end you to in which it is possible to, and take the excess pricing into account. You’ll also need to ensure your brand new financial is actually able to help you facilitate the increase into the a lot more fund and that your earnings is sufficient to be considered.

If you can reach finally your purpose along with your latest lender and you will youre proud of the experience you then maybe won’t re-finance.

On the other hand, the goal is to have the best package for you economically just in case using up a special high economic burden – such as for instance a remodelling – refinancing tends to make a great amount of sense lasting. Best talk with certain trusted finance companies to determine what’s most readily useful for you.