-

5 Shocking Truths Throughout the Opposite Mortgage loans within the 2024

5 Shocking Truths Throughout the Opposite Mortgage loans within the 2024 Katherine Realize Try a financial Journalist Known for Her Work at Economic Considered and you will Advancing years Loans, Covering Equity Release, Lifetime Mortgages, Home Reversion, Senior years Planning, SIPPs, Pension Drawdown, and you may Focus-Only Mortgages.

Rachel try an experienced Creator Providing services in for the Individual Fund, Property, Credit/Financial obligation and you may Individual Facts, That have Articles Featuring in both National Hit and you will a range of Personal Financing Other sites.

Paul Try an outward Conformity Pro and Director regarding Leader Funding Compliance Restricted, Noted for Its Direct Method to Monetary Conformity.

Francis Hui Try Elder Chance Director That have a great deal of Higher-Height Sense Across the Industry, and you will a true Expert at the Enabling United kingdom Customers Generate Wise Financial Conclusion and you will Manage Risk.

- It’s Prompt & Easy to use

- Ranked Excellent’

- Instant, online abilities

- No loans

- Simply submit a few details and we will perform some figures to you

- Comprehend the restriction count you could obtain

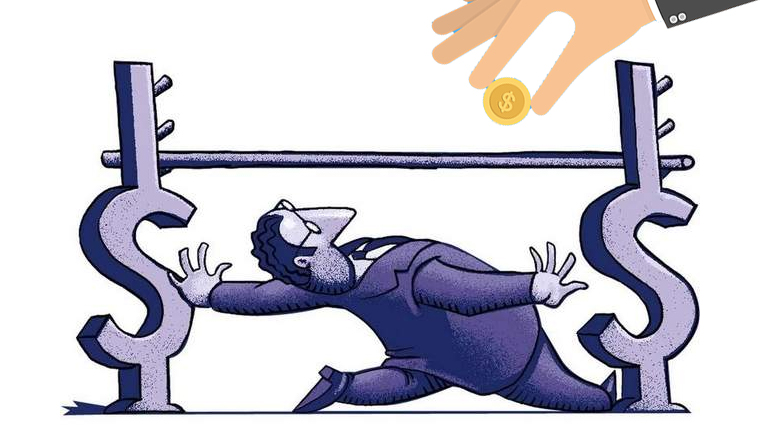

- Reverse mortgages functions by unlocking cash from the house’s well worth in the event that you are 55 or higher, turning security into income tax-totally free cash as opposed to selling right up.

- Take pleasure in cash as opposed to monthly paybacks; the borrowed funds are paid if for example the home is marketed or you are not any offered doing, regardless if a button foundation to look at is that desire grows the new obligations throughout the years.

- Keep up with your residence’s restoration, insurance rates and you may tax costs to get rid of the risk of dropping they-lenders believe repossession a past step.

Within the 2024, a face-to-face home loan lets homeowners to convert section of their house collateral towards bucks as the retaining control, having cost deferred until the house is sold. It even offers economic cover inside retirement in the midst of volatile home costs and escalating financial personal debt. step 1

Regarding different types of security discharge plans, contrary mortgages imply you can make use of the property’s equity without the need to sell otherwise circulate.

With regards to the Economic Perform Power (FCA), the latest a good worth of all the residential mortgage loans in the united kingdom try ?step 1.68tln after 2022 Q4, step three.9% greater than a-year earlier. 2

EveryInvestor’s financial experts was dedicated to providing the most current and you can direct advice to help you along with your afterwards-existence financing behavior.

This guide will bring total information on the fresh processes, experts, and considerations regarding contrary mortgages in britain to help you create a knowledgeable decision.

Opposite Financial vs. Security Release: Trick Variations in the uk

A contrary home loan now offers homeowners dollars up against their home’s guarantee, differing from Uk security discharge systems with respect to items offered, fees elements, and regulatory architecture-each designed to particular retirement capital means.

What is an opposite Mortgage?

A reverse financial, otherwise lifetime mortgage in britain, allows property owners aged 55 and over so you can borrow secured on the residence’s worth. This is certainly obtained given that a lump sum, typical withdrawals, otherwise a combo.

Monthly repayments aren’t necessary; instead, the borrowed funds and accrued interest are paid down when the residence is ended up selling, normally if citizen dies or moves on enough time-name care.

Over time, the quantity owed increases as a result of the compounding attention, that could somewhat effect possible inheritances through the elimination of this new guarantee leftover about assets.

What’s the Difference between Collateral Launch and you can a reverse Home loan?

The essential difference between security release and an Click Here opposite mortgage is dependant on their structure and you may accessibility; collateral launch try a general label included in the united kingdom, close individuals arrangements, when you find yourself an opposing mortgage is a type of guarantee launch much more commonly used in america.

Collateral launch comes with people system that allows that unlock the newest value of your home if you are continuing to live there, as well as the dos fundamental variety of equity release try lifetime mortgages and you can household reversion plans.